|

These points are widely misunderstood even among

people who purport to be value investors. Grahamites do not, as is

often asserted, ignore market and economic conditions; nor do they

exclude these considerations from their analyses. Instead, they ask

questions such as: "how unusual are the results (profits, dividends,

etc.) that X Ltd has generated over the past 5-10 years? Have

monetary and overall economic conditions given these results an

artificial or unusually favourable boost? Given general corporate

"base rates" and those for similar companies, how likely is it that

these results can continue? Are there grounds to believe that X's

results in the future will regress towards some long-term mean? If

so, does a purchase at today's price provide a margin of safety that

sufficiently offsets the risk that X's future operations might not

match those of the present and recent past?"

Precisely because they draw conclusions about the prices of many

securities, Grahamites also hold views, which are rough and prone to

error, about market indices today and several years hence. And

because they form judgements about the normality or otherwise of

today's economic conditions, they also develop opinions about booms

and busts down the road.

Graham, for example, famously warned in the late 1950s about unduly

and perhaps dangerously high asset prices (see, for example, his

articles "The New Speculation in Common Stocks" and "Stock Market

Warning: Danger Ahead!"). Conversely, he rejoiced when in the mid-1970s

he detected attractively cheap prices (see "The Renaissance of

Value" and "The Future of Common Stocks," all of which appear in

Janet Lowe, ed., The Rediscovered Benjamin Graham: Selected Writings

of the Wall Street Legend, John Wiley & Sons, 1999). Similarly,

citing implausibly high prices and correspondingly meagre prospects,

in 1969 Warren Buffett closed his investment partnership. And at

several points since the late 1990s he has warned investors to

temper their expectations about the results they might reasonably

expect during the years and decades to come (for examples, see the

references on

Leithner & Co.'s links page).

Grahamites' views about markets, interest rates, overall

profitability, etc., thus play a distinctly second fiddle to their

analyses of individual companies and securities. They incorporate

these views into their individual analyses; but within these

analyses, company-specific factors and figures always predominate.

Their approach resembles that of Lawrence Sloan, who in Every Man

and His Common Stocks (McGraw-Hill, 1931) posed three questions

about the funk then gripping the U.S. (and most other countries).

First, was the country in the midst of a severe and possibly

prolonged slump? The answer, he believed, was "yes." Second, could

astute observers have discerned signs of trouble ahead of time?

Sloan thought that they could have; and one economist, Ludwig von

Mises, certainly did (see in particular Percy Greaves, ed., The

Causes of the Economic Crisis and Other Essays Before and After the

Great Depression, Ludwig von Mises Institute, 2006).

Sloan's third

question is perhaps the most important. Could investors have

protected their portfolios from the Depression's worst effects?

Maybe but only if they were prepared to ignore the crowd and think

for themselves. The problem was that during the boom, signs of bust

were apparent only to those who sought them. As the Depression

unfolded, mixed and positive signs remained numerous enough to

persuade investors with optimistic and even neutral views of the

world that all would soon be well. Then and now, the most sensible

stance particularly when one's analysis of the past yields the

conclusion that today's prices and profits are improbably high, and

that tomorrow's harvest might be rather thin is to expect ructions,

adopt a rather dour attitude and incorporate cautious macro

possibilities into one's micro analyses. Mind the downside, in other

words, and the upside will mind itself.

How to apply this mindset to the conditions prevailing early in

2007? First, disregard high and possibly rising international

tensions. They are real, but much less severe than those prevailing

during most of the 20th century. Most notably,

the risk of terrorism

in Oz is trivial. Also, forget about the bird flu scare. As Jeffrey

Tucker shows in "Bush's Fowl Play," it is largely the concoction of

budget-maximising bureaucrats. Finally, ignore global warming. It's

a possibility; but so too, as Lawrence Solomon shows ("Will the Sun

Cool Us?"), is global cooling. And perhaps warming is a good thing.

Whatever it is, it's not a hard fact. It is, rather, an accelerating

barrow energetically pushed by (a) scientists whose status and

income depend upon the state and (b) politicians and other zealots

eagerly grasping the latest opportunity to aggrandise themselves and

plunder everybody else (see, for example, "Climate Chaos? Don't

Believe It" by Christopher Monckton). Even if global warming exists,

says

Bjorn Lomborg in

The Sceptical Environmentalist, the

interventions demanded to combat it will likely produce more harm

than good.

Put out of your mind, in short, the exotic and hypothetical risks

that are stirring ever more people into a collectivist frenzy.

Instead, focus upon a danger that is much more pedestrian, whose

evidence is much firmer, whose consequences politicians are doing

their best to ignore, and that has thus come to few investors'

attention. Why wait? Be the first on your block to recognise that

the U.S. Government likely is or before long will probably become

bankrupt.

Also, prepare financially and psychologically for the fallout that

might occur if and when people realise that Uncle Sam is broke. One

unambiguously good result would be the abandonment of the idiotic

(in its conception), inept (in its execution) and disastrous

(in its results) "war on terror." Even better would be the

consignment of America's interventionist foreign policy, which has

wrought so much damage upon so many people, including Americans, to

the same historical junkyard littered with the relics of Roman,

British, French, Russian and other imperialisms. Only people with a

material or reputational interest in warfare, such as the laptop

bombardiers on the editorial page of The Australian and The

Decider's lapdogs in Canberra, have anything to fear from the

resurrection of George Washington's

Farewell Address and America's

return to its Jeffersonian roots. The power the anointed lose is the

liberty the benighted recover.

Another positive (younger people are more likely to enjoy its

benefits) of America's bankruptcy would be the drastic pruning of

and the weaning of people from Social Security, Medicare and other

alleged government "benefits." The bad news for all Americans is

that their taxes may well rise steeply; and for everybody, Americans

and non-Americans, Uncle Sam's lurch towards insolvency implies

significantly higher inflation and interest rates. That, in turn,

augurs poorly for most financial assets.

|

Let's Define and Quantify

Our Terms |

Laurence Kotlikoff, in a must-read paper entitled "Is the United

States Bankrupt?" and published in 2006 by the St Louis branch of the

U.S. Federal Reserve, concludes that "countries can go broke, that

the United States is going broke, that remaining open to foreign

investment can help stave off bankruptcy, but that radical reform of

U.S. fiscal institutions is essential to secure the nation's

economic future

Unless the United States moves quickly to

fundamentally change and restrain its fiscal behaviour, its

bankruptcy will become a foregone conclusion." Fed Chairman Benjamin

Bernanke, in his testimony to the Committee on the Budget of the

U.S. Senate (Long-term

Fiscal Challenges Facing the United States,

18 January 2007), used much more diplomatic and less apoplectic

language, but did not reject or even question Kotlikoff's

conclusion.

Is the American Leviathan destitute? Clearly not: it continues to

possess an impressive ability to confiscate from Peter, lavish much

booty among its legions of vassals and mascots, and distribute the

rest among the Pauls whom it wishes to control. How, then, can one

possibly contend that Uncle Sam is or is going bankrupt? Beginning

in the 1930s, with another spurt in the 1960s and climaxing during

George W. Bush's presidency, he has made promises to his growing

hordes of dependents and foreign creditors that, as time passes, he

will be less and less able to fulfil. The U.S. Government is

insolvent in the sense that the net present value (NPV) of its

liabilities greatly exceeds the NPV of its assets (or the assets it

can be expected to raise in order to meet these liabilities).

Leviathan is bust in the sense that, given its vast present and

growing future shortfall of assets relative to liabilities ("fiscal

gap"), at some stage it must acknowledge reality, liquidate and

retrench. It is broke in the sense that, as occurs in many workouts,

it will pay its dependents and creditors less than it originally

promised them (see also "Broken

Army, Broken Empire" by Pat Buchanan).

Although it doesn't explicitly say so, the U.S. Government or, rather, a recent (15 December 2006) Treasury/OMB report entitled

Financial Report of the United States Government concurs (see also

"GAO Chief Warns Economic Disaster Looms" and

"Demographic

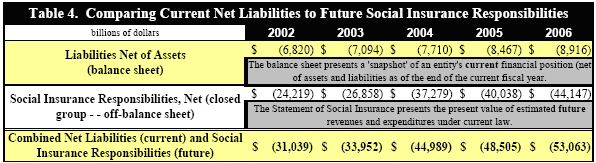

Reality and the Entitlement State" by Ron Paul). During 2006, the fiscal gap

continued to swell rapidly and now stands at ca. $53 trillion. And

that's just at the federal level. One could increase it by adding

various local and state shortfalls. Further, this figure assumes the

continuation of short- and medium-term economic sunshine, i.e., that nominal GDP will grow at a rate of

at least

5% per annum during the next five years. In other words, because the

Treasury's projections do not incorporate economic weakness, this

estimate of $53 trillion could easily err on the low side.

As a related matter, it's important to emphasise that there's literally!

no accounting for the U.S. Government. Its internal

auditor, Government Accountability Office, found for the tenth year

in succession that Uncle Sam's financial statements are unreliable

and that his financial controls are inadequate (see the Comptroller

General's

comment

on this year's Financial Report). The U.S.

Government is bankrupt in the sense that, by private sector

standards, its financial condition is not just unaudited: it is

simply unauditable.

The Pentagon's balance sheet, for example, is laughably crude. It

does not emerge from standard methods: instead, an estimated list of

liabilities is simply subtracted from a vague list of assets. A

report compiled in 2003 by its own Inspector General stated "we

identified $1.1 trillion [yes, that's a "t" and not a "b"] in

department-level accounting entries to financial data used to

prepare DoD component financial statements that were not supported

by adequate audit trails or by sufficient evidence to determine

their validity. In addition, we also identified $107 billion in

department-level accounting entries to financial data used to

prepare DoD component financial statements that were improper

because the entries were illogical or did not follow accounting

principles. . . . [In conclusion], DoD did not fully comply with the

laws and regulations that had a direct and material effect on its

ability to determine financial statement amounts."

More generally, the financial management of most (up to 20) of the

federal government's 24 largest agencies fails to meet requirements

enacted by Congress in 1996. Uncle Sam resembles nothing so much as

an inept, hopelessly spendthrift and disorganised man who hurriedly

stuffs a shoebox full of whatever documents and receipts he can find

and then throws the mess into a bewildered accountant's lap. In

the private sector, people who generate waste and loss face the ire

of shareholders, are usually denied access to capital, often receive

pink slips and running shoes and sometimes find themselves in gaol.

In the coercive sector, however, mismanagement is virtually never

punished: indeed, it is typically lauded and rewarded.

Also note that this fiscal gap does not incorporate the costs

associated with the invasions and occupations of Iraq and

Afghanistan. In "The Economic Costs of the Iraq

War," Joseph Stiglitz

and Linda Bilmes estimate that its NPV is $1 trillion or more, and

growing

(see also "Inflation:

The Hidden Cost of War" by Ron Paul). This, to

put it mildly, is somewhat higher than the initial and breezily

confident estimates of Administration and neocon insiders. Defence

Secretary Ronald Dumsfeld, for example, opined (19 January

2003) "well, the Office of Management and Budget has come up with a

number that's something under $50 billion

How much of that would

be the U.S.'s burden, and how much would be other countries', is an

open question."

A study by Jagadeesh Gokhale and Kent Smetters ("Measuring

Social Securitys Financial Problems," NBER Working Paper No.

11060, January 2005) concluded that the U.S. Government's "fiscal

gap" is closer to $65.9 trillion. That's more than 500% of America's

annual GDP and 200% of its accumulated wealth. The $53 trillion

estimate equates to ca. 400% of America's GDP in

2006, and has increased from about $20 trillion an amount

equivalent to 200% of GDP in 2000. (As a comparison, the net debt of

Her Majesty's Government is £490 billion. That's equivalent to

$US950 billion and to 38% of Britain's GDP. Adding the NPV of "off

balance sheet" liabilities produces an amount that approximates 100%

of its GDP.)

Finally, note that Treasury has expressed this $53 trillion fiscal

gap as a net present value. To make it disappear in the future

Uncle Sam must confiscate that amount now from his subjects and deposit

it in bank accounts earning hefty rates of interest (the GAO uses

5.7% as the assumed long-term rate of return). But in Main Street

U.S.A., these deposit rates do not exist. Because they didn't

collect interest on the money that they didn't deposit into these

hypothetical accounts this year, Americans will have to "deposit"

even more next year. As a matter of elementary maths, 5.7% of $53

trillion is a bit more than $3 trillion an amount ca. 15 times

greater than Uncle Sam's present annual budget deficit. Even if the

deficit suddenly became a very large surplus of, say, $500 billion

and remained at this level (a very unlikely proposition), the fiscal

gap would still continue to rise relentlessly. Accordingly, during

the next year it will likely swell by at least another $3 trillion

plus whatever additional outrages the Racketeers in the White House

and on Capitol Hill can devise. So for the sake of argument let's

add another $4 trillion, making a total of $57 trillion, as an early

guess of the fiscal gap in 2008. In last year's Financial Report,

the Treasury downplayed the gap. But this year their talk is tougher.

They state "the net social insurance responsibilities (scheduled

benefits in excess of estimated revenues) indicate that those

programs are on an unsustainable fiscal path and difficult choices

will be necessary in order to address their large and growing long-term

fiscal imbalance." Further, "delay is costly and choices will be

more difficult as the retirement of the 'baby boom' gets closer to

becoming a reality with the first wave of boomers eligible for

retirement under Social Security in 2008."

What do the present magnitude, the growth in the recent past and the

plausible rate of growth in the near future of the U.S. Government's

fiscal gap mean? As Chris Martenson notes in the

"United

States Is Insolvent," they imply three things.

|

First, it's

unlikely that America can "grow out of the problem." Uncle Sam's

financial position has deteriorated by over $22 trillion in 4

years and by $4.5 trillion during the last 12 months (see the

table below, extracted from this year's Report). The economic

sunshine of the past three years has not reduced the gap. Quite the contrary: it has widened and is deteriorating

ever more rapidly.

If the fiscal gap can balloon so quickly during allegedly good

times, what might happen if and when the economic horizon

darkens? It is unlikely, to put it mildly, that any economic

weakness will alleviate it.

Second, for many Americans, particularly younger ones and

those completely dependent upon Leviathan, the future portends

stagnant and perhaps much lower standards of living. How to

close the fiscal gap? According to Laurence Kotlikoff, "the

answers are terrifying. One solution is an immediate and

permanent doubling of personal and corporate income taxes.

Another is an immediate and permanent two-thirds cut in Social

Security and Medicare benefits. A third alternative, were it

feasible [as if the first two were politically palatable!] would

be to immediately and permanently cut all federal discretionary

spending by 143% [i.e., to eliminate all such spending and run

a mammoth and unprecedented budget surplus]." When pigs fly

Third, history shows us that every government that has so

incompetently managed its finances has tried to "print its way

out of trouble." Do American politicians possess generous

amounts of the courage required to fix this mess? Given their

country's fiscal problems, the prancing and babble of its

presidential hopefuls, and the posturing and preening of

politicians more generally, is at best a self-deception and at

worst a cruel hoax upon the public. If they truly sought, in Ms

Pelosi's words, "to build a better future for all of America's

children," then they would drastically prune if not completely

abolish the welfare-warfare state. |

The truth, of course, is that the Fed cannot

painlessly inflate, nor the pollies prattle, America's way out of

this predicament. But no matter: because draconian cuts of

expenditure are not realistic solutions to its impending bankruptcy,

inflation is a much more likely possibility. Inflation today that

is, the central bank's expansion of the money supply reduces the

purchasing power of money tomorrow. Thanks to the central bank's

inflation, the extent of debts (measured in nominal dollar amounts)

may remain unchanged or even rise; but as purchasing power falls, so

too do real values. Inflation thus imposes a hidden tax upon its

victims. What's the material difference between (a) 0% inflation and

the confiscation of x% of your money and (b) x% inflation and no

overt confiscation? Nothing: in each case, your purchasing power

falls by x%.

The rhetorical difference, of course, is that (a) is political

suicide and (b) is ignored or misrepresented in the mainstream

media. (Its demand that the central bank deliver "low interest

rates" is, in effect, a demand that the bank generate high

inflation; and the phrases "steady inflation" and "the gradual

destruction of the purchasing power of money" are virtual synonyms.)

Do not, therefore, expect that you will rise one morning to

headlines proclaiming that Uncle Sam is broke. Instead, anticipate

that it will be an extended and covert affair. The central bank's

inflation can promote only two things: the size and waste of the

welfare-warfare state and the penury of the middle and battler

classes. Indeed, to the extent that the U.S. Government's bankruptcy

takes the form of an enrichment of privileged "insiders" and the

gradual impoverishment of benighted "outsiders," it commenced years

ago and is proceeding silently apace.

The reality, then, is that Americans and non-Americans are likely to

face a future of uncomfortably high inflation and possibly worse

if somewhere down the track the $US loses its privileged status as

the world's reserve currency.

|

In the Beginning, There Was Debt |

Laurence Kotlikoff notes correctly that solvency need have nothing

to do with indebtedness. A particular government, for example, might

year after year maintain its budget in surplus and never borrow a

penny. It might laud itself as a model of fiscal prudence. But if

its liabilities outstrip its assets, and if it cannot raise the

assets required to meet its liabilities at 100 cents on the dollar

when they fall due, then this alleged model of rectitude is actually

insolvent. "To summarise," says Kotlikoff, "countries can go

bankrupt but whether or not they are bankrupt or are going bankrupt

can't be discerned from their 'debt' policies. 'Debt' in economics,

like distance and time in physics, is in the eyes (or mouth) of the

beholder."

Well said. Yet Kotlikoff overreaches when he says "the focus on

government debt has no more scientific basis than reading tea leaves

or examining entrails." Quite the contrary: although one must infer

cautiously, the source, timing and growth profile of the U.S.

Government's "on-balance sheet" debt can teach us much about

America's rise and fall, the causes of its present pickle and the

possible source of its redemption (see also William Bonner and

Addison Wiggins, Empire of Debt: The Rise of an Epic Financial

Crisis, John Wiley & Sons, 2006). America's founder knew the lesson,

but their descendents have ignored it. In James Madison's words, war

is the most serious threat to liberty and solvency "because it

comprises and develops the germ of every other. War is the parent of

armies; from these proceed debts and taxes; and armies and debts and

taxes are the known instruments for bringing the many under the

domination of the few."

Wars and economic "emergencies" are catnip

to politicians because it is during these times that the

government's powers and patronage can be extended most rapidly and thus the individual harnessed most securely to the yoke of the

state. According to H.L. Mencken (Notes on Democracy, Knopf, 1926),

"the whole history of the [U.S.] has been a history of melodramatic

pursuits of horrendous monsters, most of them imaginary: the red-coats,

the Hessians, the monocrats, again the red-coats, the Bank, the

Catholic, the slave power, Jeff Davis, Mormonism, Wall Street, the

rum demon, John Bull, the hell hounds of plutocracy, the trusts, ...

Pancho Villa, German spies, the Kaiser, Bolshevism. The list might

be lengthened indefinitely: a complete chronicle of the Republic

could be written in terms of it, without omitting a single important

episode." In this respect, the "war on terror" is simply the most

recent display in a long catalogue of deceptions. Monroe concludes

that during wars and emergencies, an "inequality of fortunes, and

the opportunities of fraud, growing out of a state of war, and ... degeneracy of manners and of morals [develops] ... No nation could

preserve its freedom in the midst of continual warfare." Certainly

the U.S. hasn't (see in particular Robert Higgs, Crisis and

Leviathan: Critical Episodes in the Growth of American Government,

Oxford UP, 1987).

The trouble is that, since time immemorial, rulers have sought to

wage war. And to do so, they must confiscate their subjects'

property. Since the 1720s, when Sir Robert Walpole revolutionised

the financial basis of the British Government, a government able to

command the confidence of lenders has also been able to issue debt

that need never be repaid. It needs only to create a regular and

dependable source of revenue a "tax base" and then use a part of

it to pay the annual interest and the principal of maturing bonds.

For every bond it retires, it also issues a new one. In this way, a

"national debt" becomes a perpetual debt. It thereby becomes an

instrument of unending war. The Royal Navy extended British

sovereignty and influence around much of the world during the 18th

and 19th centuries, and Walpole's innovation underwrote its

activities. The establishment of a national debt not only overturned

the fear of Stuart tyranny: ironically, it entrenched Jacobite

objectives into the heart of British government. HMG, in other words,

could now maintain a permanent military establishment and finance

its wars without the regular and bothersome application to

Parliament. The British Empire, then, was built upon more than the

blood of soldiers, sailors and civilians: it was a superstructure,

and a permanent national debt was its foundation. This debt had the

added benefit (to politicians) of harnessing creditors to the

government.

These developments did not escape the attention of the America's

founders. In January 1789, when General Washington mounted the steps

of Federal Hall (close to the top of Wall Street and opposite

today's New York Stock Exchange), took the oath of office and became

the first President, his newborn country's Treasury was virtually

empty. It was also burdened by debts of $77 million an amount

equivalent to ca. 30% of the new country's rudimentary GDP (this and

subsequent historical debt-to-GDP ratios have been derived from

Donald Stabile and Jeffrey Cantor, The Public Debt of the United

States: An Historical Perspective, 1775-1990, Praeger, 1991). The

rebellion against Britain had cost treasure as well as blood, and

the colonists were only slightly more willing to submit to local

than to Imperial taxes. Under the Articles of Confederation, the

admirably loose-fitting constitutional garment that had joined the

rebellious colonies, the nascent federal government possessed no

power to tax. The states could levy taxes and forward them to the

Continental Congress; but they too were hobbled by debt, and popular

hostility towards taxes was pervasive. Hence little more than a

trickle of funds flowed into the Congress's coffers (see also

Stabile's The Origins of American Public Finance: Debates over

Money, Debt, and Taxes in the Constitutional Era, 1776-1836,

Greenwood, 1998).

Alternative means were therefore sought to finance the war. As it is

doing today, Congress resorted to external creditors and the

domestic printing press (see in particular Murray Rothbard, A History of Money and Banking in the United States: the Colonial Era

to World War II, Ludwig von Mises Institute, 2002). As a result, by

the time Washington vanquished Cornwallis in 1783, American

governments owed large sums to King Louis of France, to Dutch

bankers and the thousands of American soldiers, farmers and

merchants who had lent their labour, goods and capital to the cause.

Virtually all agreed that it had been right and proper to borrow in

order to secure their political independence.

But what about the new country's financial sovereignty? Over the

next two decades, how indeed, whether the debt would be repaid

and the budget balanced became the subject of a ferocious debate

between two leading lights: Thomas Jefferson and Alexander Hamilton.

"Hamilton was indeed a singular character," Jefferson wrote of his

rival. "Of acute understanding, disinterested, honest, and

honourable in all private transactions, amiable in society, and duly

valuing virtue in private life, yet so bewitched and perverted by

the British example, as to be under thorough conviction that

corruption was essential to the government of a nation." It is only

a slight exaggeration to say that their fiscal contest was the seed

that germinated "factions" and party politics in the U.S. Washington

sat uncomfortably between them at the cabinet table and lamented the

"internal dissensions" that were "tearing our vitals."

To most early Americans, the very existence of public debt and

deficit was inexcusable. Many likened it to the seizure of property

without the owner's consent. Amassing debt to finance grandiose

national projects, and then extending this debt into perpetuity, was

widely regarded as monarchical, English and corrupting. But to a few

ιlites, most notably Hamilton and his mentor, Robert Morris, debt

was just another word for money; money was a potent form of power;

and power, they believed, was their birthright. "The [national] debt

was a tremendous source of power," wrote William Anderson in The

Price of Liberty: The Public Debt of the American Revolution (University

of Virginia Press, 1983), "for whoever controlled it would in all

likelihood possess not only the chief taxing power but the prime

allegiance of a large segment of the American population" (see also

"Perpetual

Debt: From the British Empire to the American Hegemon" by

Scott Trask, which inspired the structure of the next couple of

pages).

Jefferson, whom Washingon appointed as America's first Secretary of

State, agreed and hastened to add that the very existence of a

national debt, to say nothing of its growth, would centralise

political and economic influence into a small number of privileged

hands. It would thereby foment some of the very injustices that had

prompted people to migrate to America and had prompted Americans

to rebel against George III. Legally and ethically, said Jefferson,

"we should consider ourselves unauthorised to saddle posterity with

our debts, and morally bound to pay them ourselves."

|