| |

|

Austerity, What Austerity? Europe Desperately Needs "Genuine

Austerity" | Print Version |

|

by Chris Leithner* |

Le Québécois Libre, December

15, 2013, No 317

Link:

http://www.quebecoislibre.org/13/131215-6.html

Echoing John Maynard Keynes, today's Keynesians insist that times of

bust are the right time for the government to indulge in extravagance―and the wrong time to return to sobriety. Indeed, Paul Krugman and his

followers go well beyond Keynes: any time is the right time for

profligacy and the wrong time for frugality (see also Paul Krugman,

Keynes Was Right,

The New York Times, 29 December 2011). Krugman and others also

allege that, particularly in Europe, the bailouts and other so-called

stimulus which panic-stricken policymakers “injected” into the structure

of production in 2007-2008 has subsequently been replaced by

“austerity,” and that this austerity has scuttled recovery.

The exemplar of austerity-as-poor-policy, they say, is Greece. That

country, pressured by the EU in general and Germany in particular,

decreased its budget deficit from 10.4% of GDP in 2010 to 9.6% in 2011;

other countries, such as Iceland, Italy, Ireland, Portugal, France and

Spain, also decreased their deficits relative to GDP from 2010 to 2012.

As a consequence of this austerity, Keynesians insist, economic

conditions and prospects have worsened.

He’s no fan of Keynesians, yet Paul Roderick Gregory (“Austerity”

To Blame? But Where’s the Austerity?

Forbes, 26 May 2013) accurately summarises their position:

Die-hard Keynesians bemoan [the fact] that, with a few exceptions, the

world’s economies are drowning in the quicksand of austerity. They

preach we need more government spending and stimulus, not less. Northern

Europe should bail out its less-fortunate neighbours to the South so

they can pay their teachers, public employees and continue generous

transfers to the poor and unemployed. If not, Europe’s South will remain

mired in recession. In America, Keynesians entreat the skinflint

Republicans to loosen the purse strings so we can escape sub-par growth.

They advise Japan to spend itself out of permanent stagnation and

welcome recent steps in this direction.

The stimulationists complain that they have been overwhelmed by the

defeatist austerity crowd, [led] by the un-neighbourly Germans and the

obstructionist Republicans. If only Germany would shift its economy into

high gear while transferring its tax revenues to ailing Southern Europe,

and the rascally Republicans drop the sequester cuts, we would be

sailing along to a healthy worldwide recovery. We don’t need spending

restraint. Instead, we need stimulus, stimulus, and more stimulus to

revive economic growth. We’ll deal with the growing deficits later, the

stimulation crowd tells us, but we must first get our economies growing

again.

The official Keynesian story is that the PIIGS of Europe (Portugal,

Italy, Ireland, Greece and Spain) have been devastated by cutbacks in

public spending. Austerity has made things worse rather than better―clear proof that Keynesian stimulus is the answer. Keynesians claim the

lack of stimulus (of course paid for by someone else) has spawned costly

recessions which threaten to spread. In other words, watch out Germany

and Scandinavia: If you don’t pony up, you’ll be next.

Keynesians see financial crises and economic busts as largely

unpredictable events that governments must prevent at all cost―or,

once they occur, move heaven and earth to alleviate. Adherents to the

Austrian School of economics, on the other hand, explain crises and

busts as the inevitable result of the unsustainable (because it is

artificial) boom provoked by government intervention in general and

central and fractional-reserve banks’ excessive expansion of credit in

particular. Bankers grant the worst loans during the superficially best

times. For Austrians, the boom isn’t a blessing; it’s a curse. Moreover,

recession isn’t a curse: it’s a cure. The bigger is the preceding

artificial boom, the more severe will be the consequent genuine bust.

The recession is the hang-over that follows the blinder; it’s the

cold-turkey that’s necessary in order to kick the addiction to

artificial credit (see in particular Murray Rothbard,

Economic Depressions: Their Cause and Cure).(1)

Like the big bushfire that eliminates the underbrush that the government

forbade landowners to use small fires to remove, the recession is an

inevitable and necessary phase of the business cycle. The bust rids the

economy of the detritus, distortions and mal-investments that

accumulated during the boom. Resources that have been put to

unproductive uses (not least by governments’ perverse incentives,

regulations, decrees, etc.) must either be shifted to sectors where

genuine demand exists―or be liquidated. Clearly, this clean-up and

reorganisation can’t occur overnight; accordingly, some resources must

remain idle until entrepreneurs can find a sensible way to deploy them.

This means that unemployment will temporarily rise, that plant and

equipment will lie partly or fully idle until it can be retooled or

scrapped, and that financial resources will be used to repay debt and

“parked” in short-term assets instead of invested in long-term projects.

To Austrians, then, recession, unemployment and the like aren’t

consequences of austerity; they’re results of the stimulus that kindled

the artificial boom.

Accordingly, governments mustn’t try to retard, delay or prevent this

process of retrenchment, reallocation and recuperation. During the

recession caused by stimulus, in other words, they should avoid further

“stimulus” like the plague. Keynesian “pump-priming,” “automatic

stabilisers,” bailouts and so on vainly sustain the artificial boom,

corrupt the necessary bust and thereby delay and weaken any genuine

recovery. Stimulus is akin to giving a drunk another bottle of whiskey

and an addict another “hit” of heroin. It doesn’t just delay recovery;

in sufficiently large doses it will kill the patient. Stimulus also

creates a climate of uncertainty (Robert Higgs calls it “regime

uncertainty”)

which deters private investment. In short, Keynesians and Austrians

recommend diametrically opposite policies to combat financial and

economic crisis. Keynesians demand that governments redouble their

spending and intervention; Austrians recommend that they slash their

expenditures, taxes, legislation and regulation.

What, exactly, is austerity?

Given these diametrically opposite diagnoses and prescriptions, how

should we view the current situations in Europe? Has austerity prolonged

the crisis, as Keynesians believe? Or, as Austrians maintain, is austerity a necessary condition of recovery?

In order to answer these questions, we must define this key term.

“Austerity measures,” says

The Financial Times Lexicon,

“refer to official actions taken by the government, during a period of

adverse economic conditions, to reduce its budget deficit using a

combination of spending cuts or tax rises.” It adds: “various austerity

measures have been announced since the global recession in 2008 and the

Eurozone crisis in 2009.”(2)

Given the FT’s conception, a sufficient condition of austerity is the

joint occurrence of four things (the first and last of which are

necessary conditions). Specifically, austerity is (a) a decrease of the

government’s budget deficit which has been caused by either (b) a

decrease of government spending or (c) an increase of tax revenues (or

both b and c) and which (d) occurs during a period when GDP is stagnant

or falling. Most descriptions of and disputes about austerity follow the

FT’s conception. They have focussed upon two macroeconomic indicators,

both expressed as a percentage of GDP: (1) the government’s budget

deficit and (2) debt as a percentage of GDP. The lower the deficit (that

is, the higher the surplus) and the more the debt shrinks, the more

austere is the policy.

More generally, it seems to me that austerity means not just that the

government temper but that it abandon its profligacy. It doesn’t merely

tug the fiscal belt slightly: it yanks as hard as necessary in order to

live within its means. Austerity means that when a government

figuratively stands in the doctor’s surgery and receives an unvarnished

diagnosis―namely that it’s bloated and unfit―it doesn’t choose the

slack option. It doesn’t borrow in order to buy even bigger trousers:

instead, it convincingly resolves immediately to fit into smaller

clothes by adopting a strict diet and commencing rigorous training. At a

minimum, austerity worthy of the name means that the government

eliminates its budget’s deficit; more ambitiously, it means that both

its spending and its revenues fall significantly, even drastically, that

its expenditures quickly become smaller than its shrunken revenues, and

that it uses the resultant budget surplus to repay a significant portion

of its debt.

Are governments and households, in at least one key respect, comparable? “What is prudence in the

conduct of every private family,” wrote Adam Smith in

The Wealth of Nations

(1776), “can scarce be folly in that of a great Kingdom.” Here, too,

Keynesians and Austrians differ diametrically. Austrians reason from two

premises. Firstly, households and businesses cannot live indefinitely

beyond their means; secondly, the government confiscates either from

households or businesses. From these premises it follows that

governments, like the households and businesses that finance them,

cannot live indefinitely beyond their means. And because nobody can live

indefinitely beyond his means, everybody (including the government) must

ultimately live within his means. If he doesn’t, then as a matter of

elementary logic he must live within somebody else’s means―whether

that somebody else is aware of it or not, and regardless of whether that

somebody likes it no not. From the point of view of the Austrian School

of economics, then, austerity is moral and rational, and profligacy is

immoral and irrational.

Keynesians utterly reject these premises and reasoning, as well as the

morality that underlies it. In the words of James K. Galbraith (In

Defense of Deficits, The Nation,

4 March 2010:

It may seem

like homely wisdom to say that “just like the family, the government

can’t live beyond its means.” But it’s not. In these matters the public

and private sectors differ on a very basic point. Your family needs

income in order to pay its debts. Your government does not … With

government, the risk of non-payment does not exist. Government spends

money (and pays interest) simply by typing numbers into a computer.

Unlike private debtors, government does not need to have cash on hand …

No government can ever be forced to default on debts in a currency it

controls. Public defaults happen only when governments don’t control the

currency in which they owe debts―as Argentina owed dollars or as

Greece now (it hasn’t defaulted yet) owes Euros. But for true

sovereigns, bankruptcy is an irrelevant concept. When Obama says, even

offhand, that the United States is “out of money,” he’s talking nonsense―dangerous nonsense. One wonders if he believes it. Nor is public debt

a burden on future generations. It does not have to be repaid, and in

practice it will never be repaid.

A question to Galbraith: if you’re right, then why does the government

bother to levy taxes? Why doesn’t it simply borrow whatever it pleases,

without limit, every year?

Keeping the broad conception of austerity (i.e., “living roughly within

one’s means”) and its morality in mind, it’s worth mentioning that, for

members of the EU, austerity or some rough facsimile thereof is a key

promise and treaty obligation. It’s also important to repeat:

descriptions of and disputes about austerity have focussed upon two

macroeconomic indicators, both expressed as a percentage of GDP: (1) the

government’s budget deficit and (2) its debt as a percentage of GDP. The

Maastricht Treaty of 1992

stipulates that the budget deficit of a country joining the EU must be

no greater than 3% of its GDP, and that its level of debt must be no

higher than 60% of GDP. These are also “goalposts” for member countries;

fortunately for them and unfortunately for people who believe

politicians, however, few take these “Maastricht criteria” seriously.

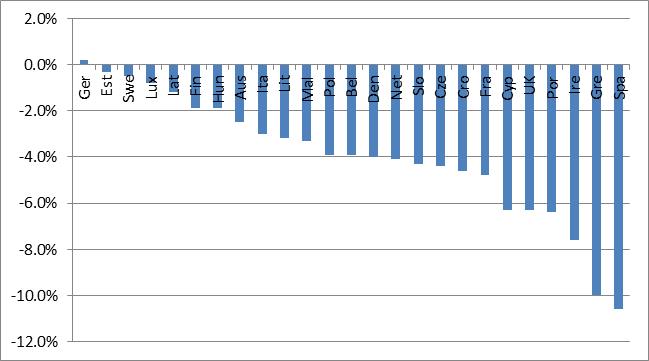

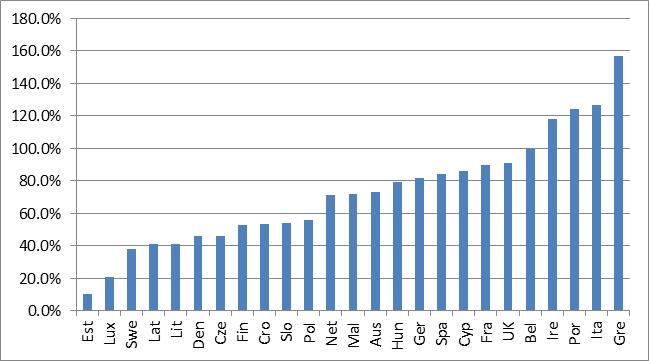

Figure 1 shows that the budget deficit of the average EU member state is

presently (mid-2013) 4.0% of GDP, and Figure 2 shows the government debt

of the average member of the EU is 72.5% of GDP. It’s rather comical: by

these criteria the average EU country doesn’t qualify (according to

Maastricht criteria) for admission to the EU! Indeed, all major EU

nations except Germany fail the budget deficit test: Britain, France,

Italy and Spain all do. And all of the EU major member states, including

Germany, fail the debt-to-GDP criterion. (www.tradingeconomics.com

is the source of these and all subsequent presentations of data from EU

countries.)

Figure 1: Ratio of Government Budget Surplus or Deficit to GDP (%), EU

Members, 2013

Figure 2: Ratio of Government Debt to GDP (%), EU Members, 2013

By these two criteria, in other words―which are not mine but are

rather part of the EU’s “architecture”―there is no “austerity” in

Europe.

Virtually without exception, member states of the EU aren’t honouring

their obligations under the Maastricht Treaty. Because they’re not

living within their means, according to criteria agreed by treaty more

than 20 years ago, they’re not practicing austerity.

Three Varieties of Austerity

Recall from The Financial Times Lexicon that measures of

austerity reduce the government’s budget deficit. If the deficit is

rising, then by definition there’s no austerity. How to trim a deficit?

The government must cut its spending, increase its revenue or adopt some

combination of these two things. Generally speaking and regardless of

their rhetoric, politicians of all partisan stripes love to increase

expenditure and reduce taxes (which rewards their mascots), and they

hate to reduce expenditure and to increase taxation (which punishes

their followers). Two varieties of austerity, one legitimate and the

other bogus, thus follow:

Genuine Austerity

Politicians’ and bureaucrats’ least favoured way to reduce the deficit

is to implement genuine austerity, i.e., to cut spending drastically

(both in absolute terms and as a percentage of GDP) and to slash taxes

considerably. If they do these things (such that the government’s

revenues decrease and its expenditures fall even more, thereby turning

the budget suddenly and sharply into surplus), and if they use this

surplus to trim the debt, they shrink the size of the state; and if they

do so whilst GDP is stagnant or falling, then they’re implementing

“genuine” austerity.

Not Genuine But Not Completely Fraudulent Austerity

The intermediate (but still relatively unappealing, if you’re a

politician or bureaucrat) way to reduce the government’s budget deficit

is to (1) halt the growth of spending for a short period of time and (2)

greatly increase its revenues (by either increasing the rate of existing

taxes, or introducing new taxes, or both) for a long time. These two

measures, plus (3) the hope that the growth of GDP resumes quickly

enough to remove the pressure to take further unpalatable decisions, may

reduce the deficit somewhat as a percentage of GDP, but probably won’t

decrease it in absolute terms. And it’ll do nothing to reduce debt;

indeed, debt (in absolute terms, if not as a percentage of GDP) may

rise; for this reason, the state continues inexorably to grow. This

approach, broadly speaking, describes short periods in the 1980s in

Britain and the U.S.

Faux austerity

“Faux” (false) austerity entails higher government expenditure, albeit

perhaps at a slower pace than during the era before “austerity”

commenced. A deceleration of the rate of increase of government

expenditure, in other words, underpins

faux austerity (in mathematical terms, the second derivative becomes

negative, but the first derivative remains positive). So too do either

increases of existing taxes or the introduction of new taxes, which

increase the government’s revenues more quickly than its expenditure,

and thereby reduce its deficit. Unlike genuine austerity, which shrinks

the state’s income statement and balance sheet, faux austerity, which is

typically financed by borrowing (often at an accelerating pace) produces

an ever-bigger state. This, or something roughly like it, occurred in

Britain during most of the Thatcher years, most of the Reagan years in

the U.S. and during the early Howard years in Australia. As we’ll see

shortly, it also characterises the EU and U.S. since 2007.

In principle, then, “austerity” of one or another of these varieties can

cover many different and otherwise incommensurate situations.

Specifically, it can apply just as well to (a) the common situation

where the size of the state increases rapidly, (b) the ubiquitous

situation where the size of the state rises at a relatively steady pace

and (c) the very rare situations where the state suddenly shrinks

meaningfully.

A Textbook Example of Genuine Austerity That Appears in No Mainstream

Text

Have you heard of the Depression of 1920-1921? I thought not. Why not?

Probably because, as I detailed in

The Evil Princes of Martin

Place, it ended so quickly. Why did it end so quickly? The U.S.

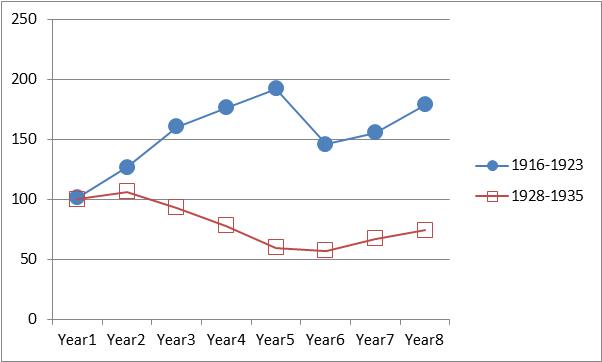

Government quickly and resolutely implemented genuine austerity. Figure

3 plots U.S. GNP during two eight-year periods: 1916-1923 and 1928-1935.

To aid comparison of these two intervals, it standardises GNP in the

first year of each at 100. (Historical Statistics of the United

States is the source of this and subsequent figures that use

American data before 1970.)

Figure 3: U.S. GNP (Year 1=100), 1916-1923 and 1928-1935

Figure 3 shows that the decrease of GNP between 1920 and 1921 (a

whopping 24%) was far greater than in any single year of the Great

Depression. From the peak in 1929 to the trough in 1933, GNP in the U.S.

fell by a cumulatively greater amount (46%); but during the first three

years of the Great Depression, GNP fell only slightly more (26%) than it

did in the single year from 1920 to 1921. Not only was 1920-1921 (to use

the phrase of the FT Lexicon) a “period of adverse economic conditions”:

it was, economically speaking, America’s single worst interval of the 20th

century. Notice, however, that after 1921 GNP rose sharply: from 1921 to

1922 it rose 6.5%; from 1922 to 1923 it soared almost 15%; and

thereafter (not shown) it continued to rise strongly. The Depression

of 1920-1921 was the severest in America’s 20th century

history; it was also the shortest in America’s 20th century

history. That latter attribute is perhaps why few Americans remember

it.

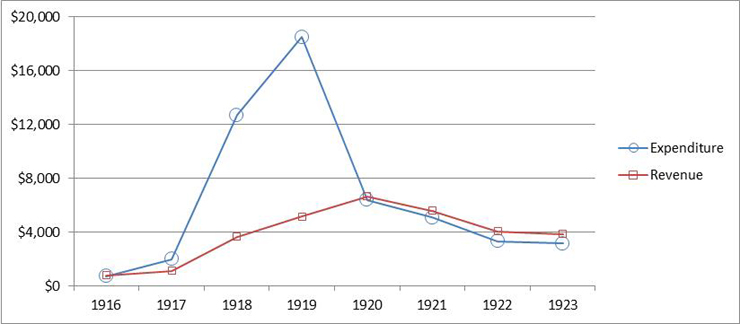

Figure 4: Expenditure and Revenue, U.S. Government ($m), 1916-1923

How did the U.S. Government respond to the Depression of 1920-1921? By

drastically slashing both expenditures and revenues, in absolute terms

and also as a percentage of GNP; in other words, it did the diametric

opposite of what Keynes recommended in 1937 and what Krugman and others

demand today. Indeed, slashing its taxing and spending, which the

First World War had bloated massively, likely triggered (as opposed to

caused) the Depression. (The preceding “stimulus,” in the form of the

massive growth of government during the First World War, and the

aggressive interventionism of the Federal Reserve, which was formed in

1913, caused the Depression.) Figure 4 shows that the U.S. Government’s

expenditure skyrocketed from $713 million in 1916 to $18.5 billion in

1919; spending then plummeted to $6.4 billion in 1920, $5.1 billion in

1921, $3.7 billion in 1922 and $3.5 billion in 1923. That’s no

typographical error: from the crest of the wave of spending in 1919 to

its trough in 1923, the U.S. Government’s expenditure plunged 81%.

Revenue followed a similar but less extreme path: it rose from $761

million in 1916 to $6.6 billion in 1920, and then fell steadily to $3.9

billion in 1923. Also note that from 1920 to 1921, which we saw in

Figure 3 was the single worst year in the 20th century, the

U.S. Government’s revenue fell 20% (from $6.4 billion in 1920 to $5.6

billion in 1921); from 1920 to 1923, revenue fell 42%.

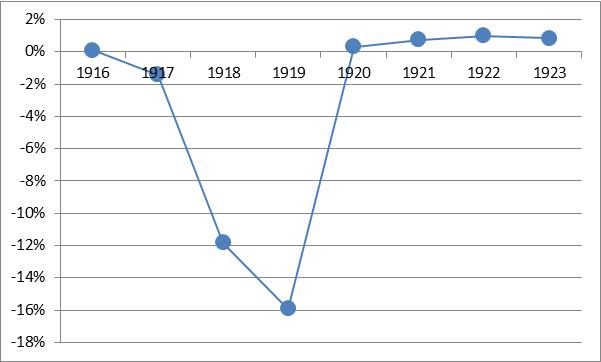

Figure 5 expresses the U.S. Government’s surplus/deficit in each of

these years as a percentage of GNP during the relevant year. In 1916,

the government roughly balanced its budget; in 1917, as America entered

the First World War, it ran a huge deficit (ca. 12% of GNP); and in 1919

(the war ended in November 1918, but the spigot took a bit of time to

seal), its deficit was even bigger (ca. 16% of GNP). Notice, however,

that within a year the government’s budget returned to surplus (ca. 0.5%

of GNP in 1920), and that for the next three years it remained in

surplus. Notice, too, that during the Depression of 1920-1921 the

U.S. Government’s budget surplus increased. During the worst year of the

20th century, in other words, the government’s spending

plunged even more rapidly than its revenue. This, I think, is why

Keynesians utterly ignore the Depression of 1920-1921 and attempt to

rationalise it when reprobate students bring it to their attention:

Keynesians simply cannot explain how the drastic shrinkage of the

government’s taxing and spending immediately preceded the strongest

recovery of the 20th century. What they cannot explain, they

ignore or deny.

Figure 5: the U.S. Government’s Budget Surplus/Deficit, Percentage of

GNP, 1916-1923

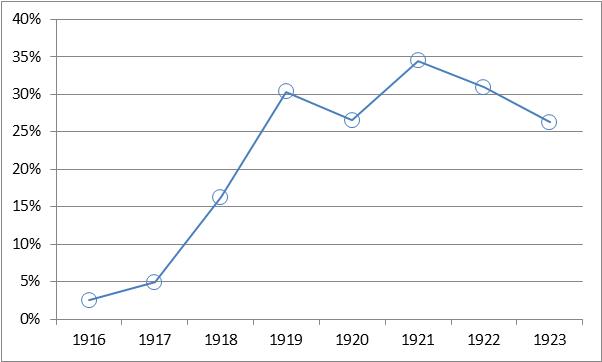

What did the U.S. Government do with the surpluses it generated after

1920? It used them to repay some of the debt which had exploded

during the First World War. Figure 6 expresses the U.S. Govern-ment’s

debt during a given year as a percentage of GNP during that year.

Admittedly, debt rose between 1920 and 1921. This, presumably, was the

final installment of a longer series: the First World War caused

America’s debt to balloon from ca. 3% of GNP in 1916 to 35% in 1921. By

1923, however, debt was closer to 25% of GNP―a far cry from the level

in 1916, to be sure; equally certainly, it was significantly less in

1923 than it was in 1921.

Figure 6: Ratio of Debt to GNP, U.S. 1916-1923

Let’s recapitulate. The Depression of 1920-1921 was the severest in

modern American history. Yet the recovery in 1921-1923 was the most

robust in that country’s modern history. How do we explain these facts?

The Austrian School tells us that the genuine austerity of the U.S.

Government, which quickly and thoroughly removed many of the

distortions, malinvestments, etc., introduced during the war, had much

to do with it. The implication is vital: genuine austerity doesn’t cause

misery, it resolves it. Genuine austerity purges the rottenness of the

false boom and thereby sets the stage for genuine recovery. Faux

austerity and Keynesian-style stimulus, on the other hand, cause misery

and indefinitely postpone recovery.

The EU and U.S. since 2005: No genuine austerity but plenty of faux

austerity

Presently, the critics of austerity take it for granted that governments

in the EU (particularly the PIIGS) have drastically their expenditure.

It’s also an article of faith among these critics that this alleged

austerity (which, they maintain, has also occurred in the U.S.) has

shrunk if not eviscerated the state. Do the facts support these

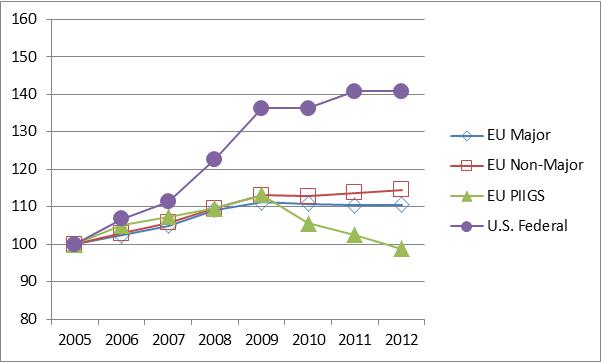

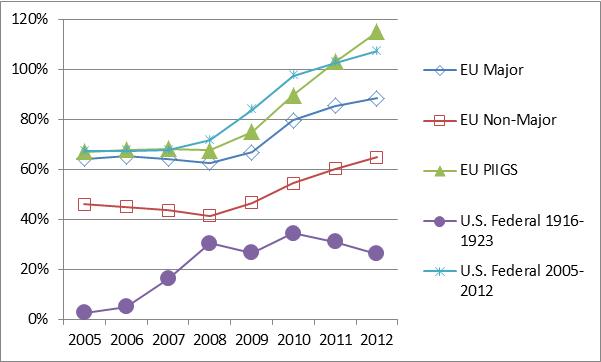

assumptions? Figure 7 sorts EU member states into three

slightly-overlapping categories: (a) major members (Britain, France,

Germany, Italy and Spain), PIIGS (Portugal, Ireland, Italy, Greece and

Spain) and non-major members (i.e., all others), and expresses overall

government expenditure in each category relative to 2005 (=100).

Figure 7: Government Expenditure, EU and U.S., 2005-2013 (2005=100)

In the U.S., expenditure increase by 40%―that is, at a compound rate

of 4.9% per year―between 2005 and 2012. Government expenditure also

increased, albeit more slowly, across the EU from 2005 to 2009. It

increased by 12-14% and at a compound rate of 2.8-3.3% per year. In

2009-2012, on the other hand, spending changed little in major member

states, increased slightly (by a total of ca. 3% and at a compound rate

of 0.6% per year) in non-major states, and fell (by a total of 12% and

at a compound rate of 4.4%) in the PIIGS.

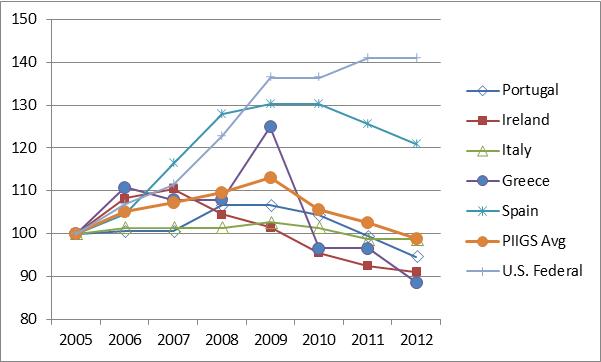

Figure 8 plots total government expenditure (2005=100) in Portugal,

Ireland, Italy, Greece and Spain between 2005 and 2012. It shows that

expenditure rose

in 2005-2008. On average in these countries, it rose 10% (i.e., at a

compound rate of 3.2% per year) during this interval. It rose 28% in

Spain (compound rate of 8.9% per year), between 5-10% in Portugal,

Ireland and Greece (compound rate of ca. 2.3-2.5% per year) and changed

little in Italy. Conversely, in 2008-2012 expenditure fell. It fell 11%

in Portugal (at a compound rate of 3.9% per year), 13% in Ireland (4.4%

per year) and 17% in Greece (6.3% per year). Does this more recent

shrinkage of government expenditure confirm that these three PIIGS, at

least, have endured austerity?

Figure 8: Government Expenditure, PIIGS and U.S., 2005-2012 (2005=100)

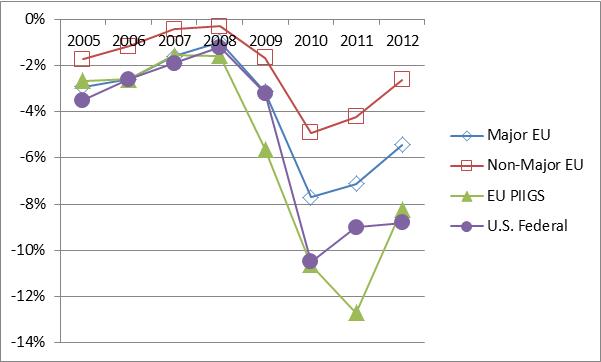

Not really. Figure 9 plots average annual budget deficits (expressed as

a percentage of each country’s GDP) in the U.S. these three categories

of EU member states.

Recall the Financial Times Lexicon: “…

various austerity measures have been announced since the global

recession in 2008 and the Eurozone crisis in 2009” (italics added).

Clearly, however, by and large they haven’t been implemented. A

decrease of the government’s budget deficit is a necessary condition of

austerity. Without exception, however, budget deficits across the EU

have been considerably greater since 2009 than they were before then.

But nobody denounced these deficits as “austere” then; so how can

Keynesians do so now?

Figure 9: Budget Deficits as a Percentage of GDP, EU and U.S., 2005-2012

It’s true that in 2012 deficits were smaller than they were in 2010 and

2011. The average deficit in major EU countries was smaller in 2012

(-5.4% of GDP) than it was in 2010 (-7.7%); the average deficit in

non-major countries was also less in 2012 (-3.6%) than in 2010 (-6.0%);

finally, the deficit in the average deficit in PIIGS nation was smaller

in 2012 (-8%) than in 2010 (-11%) and 2011 (-13%).

The trouble, of course, is that “stimulus” rules: across the EU, as well

as in the U.S. budget deficits remain very large―smaller than at their

nadir, but nonetheless far greater than before 2009. Whereas

Keynesians decry “austerity” in 2012 vis-à-vis 2010, Austrians see

“stimulus” after 2009 vis-à-vis the boom until 2007.

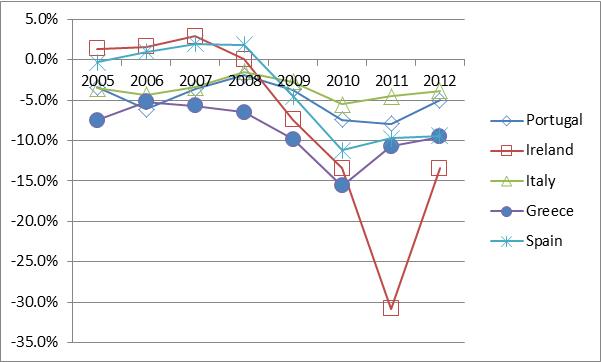

Figure 10: Budget Deficits as a Percentage of GDP, PIIGS Nations,

2005-2012

Not only do Figures 7-11 show no compelling evidence of genuine

austerity; they demonstrate that the evidence of faux austerity is

strongest in the U.S. and PIIGS nations. Although government expenditure

in the PIIGS nations has fallen in 2009-2012 (Figure 7), it remains far

too high relative to revenues. Accordingly, as their budget deficits

have ballooned (Figure 8), governments have borrowed increasingly

heavily, and the PIIGS and U.S. Government have borrowed most heavily of

all (Figure 10 and 11). As a result, since 2009 the average PIIGS government’s

debt as a percentage of GDP has risen from ca. 75% to almost 120%, which

is only slightly greater than America’s. That’s evidence of profligacy

and an even more bloated state―not of genuine austerity and a leaner

and fitter state.

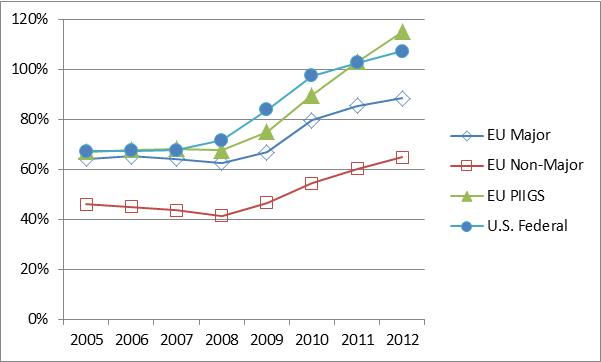

Figure 11: Government Debt to GDP (%), EU and U.S., 2005-2012

Why the “Recovery,” Particularly Among the PIIGS, Has Been So Anaemic

Keynesians in general and Paul Krugman in particular insist that the

recovery in the EU and U.S. has been so anaemic because the stimulus and

bailouts, etc., in 2007-2009 were too feeble, and because “austerity”

(as we’ve seen, faux prosperity is a more accurate description) replaced

Keynesian stimulus. They’re demonstrably and diametrically wrong:

recovery has been so feeble not because austerity has been much too

severe; it’s been so weak because “austerity” has been far too timid.

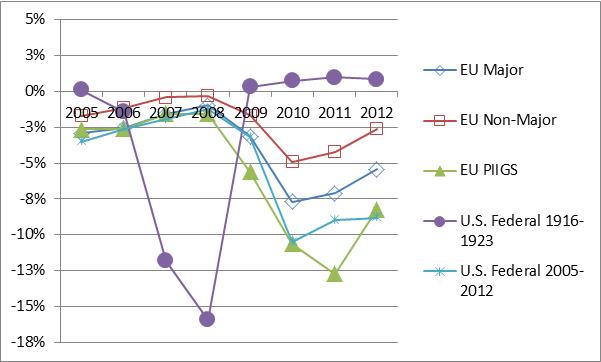

Figure 12 combines data from the U.S. in 1916-1923 (Figure 5) and from

the EU in 2005-2012 (Figure 9). It shows that the faux austerity that

Krugman and others decry simply bears no comparison to the genuine

austerity that the U.S. Government implemented in the early 1920s. In

effect, the welfare-warfare state weights almost as heavily today upon

the EU and U.S. today as the First World War did upon the U.S.

Government. The inference is clear: whereas the Americans’ genuine

austerity quickly and thoroughly put the government’s house into some

semblance of order, the PIIGS finances remain in disarray. The

Americans’ genuine austerity created the conditions of genuine recovery;

in sharp contrast, the PIIGS’ faux austerity has begotten a faux

recovery.

Figure 12: Budget Deficits (% of GNP/GDP), 1916-1923 and 2005-2012

Figure 13 combines data from the U.S. in 1916-1923 (Figure 6) and from

the EU in 2005-2012 (Figure 10). In the early 1920s, the U.S. Government

implemented genuine austerity; as a result, its debt (expressed as a

percentage of GNP) fell significantly. By today’s lax standards, in the

1920s the U.S. Government was astonishingly trim; accordingly, it didn’t

block the road to economic recovery. In sharp contrast, today in the EU

and U.S. debt continues to gallop upwards; as a result, the bloated

government has “crowded out” private recovery.

Figure 13:

Ratio of Debt to GNP/GDP, 1916-1923 and 2005-2012

Three Conclusions

Never mind Paul Krugman: at no time since 2005 have governments in the

EU or U.S. implemented genuine austerity. Instead, they’ve recently

championed faux austerity. Accordingly, their “recoveries” from the

economic and financial crisis are feeble and artificial; moreover, like

Australia they remain vulnerable to renewed economic and financial

crisis.

1. Today, Austerity Is Everywhere Except in the Statistics

A researcher at the German Institute for Economic Research, Georg Erber,

The Austerity Paradox: I See Austerity

Everywhere, But Not in the Statistics,

28 February 2013), examines in much greater detail than I have the EU’s

official statistics.

Erber writes:

… taking a close look at the actual statistics available from Eurostat

on the PIIGS-countries plus Cyprus, one finds little empirical evidence

that the governments there [or in the EU more generally] have de facto

reduced their total public expenditures. This is in stark contrast to

the current austerity debate, which seemingly implicitly assumes that

austerity has occurred over the past couple of years since the global

Great Economic Crisis broke out in 2008.

The PIIGS remind me of the patient whose doctor orders him to lose

weight by eating less. The patient responds by doubling his calorie

intake. He later cuts back by ten percent and wonders why he is not

losing weight. The PIIGS went on a spending binge from which they do not

want to retreat. They then blame their problems on austerity and the

lack of charity of others.

So much for the scourge of austerity in … Europe. The facts show it

simply does not exist. Instead of “where’s the beef?” we should ask

“where’s the austerity?” Perhaps economist [Paul] Krugman can find it.

But first I would advise him and others like him to consult some facts

before they pontificate.

Adam Creighton agrees. In

Nothing Austere about Europe’s Fiscal Policies

(The Weekend Australian, 11-12 May 2013), he writes:

If thought corrupts language, language can also corrupt thought. A bad

usage can spread by tradition and imitation even among people who should

and do know better. In 1946 George Orwell famously pointed out how

politics degraded and abused the English language for the sake of

political ends. The same is true in economics. The word austerity, used

to describe European and even U.S. fiscal policy, has been a clever ruse

by opponents of measures that may cause any reduction in the size of

government.

No objective, sane person could describe, in a relative or absolute

sense, fiscal policy in Europe or the US as austere, a word stemming

from the Greek meaning harsh or severe. … Government budget deficits in

Europe are still up to twice as large as they were before the GFC―when

no one described them as austere―and are contributing to already vast

public debt burdens. Far from the “savage cuts” of [former Treasurer]

Wayne Swan’s imagination, European governments have reduced only the

rate of growth of public spending. Even in Greece, a country with little

population or economic growth in recent years, spending is still greater

than it was five years ago.

Yet “mindless austerity” has become a favourite phrase of the Treasurer

since [Swan] dumped his promise to restore the budget to surplus this

financial year. … The Treasurer is trying to convince Australians that

cutting public spending would undermine “jobs and growth.” Whatever is

undermining jobs and growth in Europe, it is likelier to be a bizarre

fondness for bad economics than spending cuts.

Creighton quotes Alberto Alesina, a professor of economics at Harvard

University:

[There is] vast evidence showing spending cuts are much less

economically costly than tax increases to restore budgets to surplus …

Lower spending reduces the expectation of higher taxes in the future,

with positive effects on … investors. … Most countries in Europe are

actually raising taxes and not cutting expenses; what happens in

practice is typically quite different from what is announced (see also

Adam Creighton, “Economists Attack Wayne on Austerity/Dons Slam

Treasurer on Austerity Stand,” The Weekend Australian, 11-12 May

2013).

2. Keynes was wrong and Krugman is similarly wrong―and the Austrians

have been correct all along

“The boom, not the slump, is the right time for austerity at the

Treasury,” John Maynard Keynes asserted in 1937. That’s flatly wrong.

The greatest slump in the 20th century history of the U.S.

occurred in 1920-1921. The Depression of 1920-1921 was the shortest in

America’s 20th century history―and the recovery from the

Depression of 1920-1921 was the most robust in America’s modern history―precisely because the U.S. Government followed the opposite―and

correct―path. It demonstrated that the bust is a correct time for

genuine austerity. Krugman, too, is diametrically wrong. The truth is

that any time, boom or bust, is the right time for the state to

adopt frugality and the wrong time to embrace extravagance.

What’s more, we’ve long known that Keynes and Krugman are wrong. (See

the quotes by John Stuart Mill and James Callaghan after the Overview.)

Martin Masse (Is

“Austerity” Responsible for the Crisis in Europe?

Mises Institute, 11 June 2013) adds two final points. Governments in

almost all member nations of the EU are now at least as large, and

probably larger, than in 2007. If (like The Financial Times Lexicon)

we define austerity as measures undertaken which reduce the government’s

budget deficit, then faux austerity has deepened the crisis. And if we

define genuine austerity as policies which reduce the size of

government, then Keynesians―if they are intellectually honest―must

exonerate genuine austerity from all blame. Genuine austerity hasn’t

deepened the crisis because since 2007 it has never been applied.

“Unfortunately,” Masse concludes, “confusion over the meaning of

austerity impedes a better understanding of the situation and precludes

a more relevant debate over the causes of and solution to the crisis.”

He continues:

Keynesians will, of course, regret that even larger increases of

government borrowing and deficit spending hasn’t occurred. These things,

which certainly have marked the state’s finances during the past few

years, have been implemented in order to “stimulate” the economy. But,

from an Austrian perspective, bloated governments and higher taxes help

to explain why, several years after the financial crisis, American and

European economies are still in the doldrums.

3. Genuine austerity doesn’t kill―But faux austerity does cause misery

How to respond to claims such as

Why Austerity Kills: From Greece to U.S., Crippling Economic Policies

Causing Global Health Crisis

(Democracy Now! 21 May 2013)? The Depression of 1920-1921

demonstrates that genuine austerity doesn’t cause misery: it removes it.

Genuine austerity sets the stage for genuine recovery. Faux austerity,

on the other hand, corrupts recovery and thereby causes misery. Not

just for material reasons, then, but also on moral grounds, what the

world desperately needs is drastically smaller government: not just a

much smaller quantity of taxing and spending, but also a vast pruning of

legislation and deregulation of capital and labour. These measures will

encourage savings, investment and entrepreneurship. They―and not more

taxing, spending, legislating and regulating―will thereby set a sound

foundation for a return to prosperity.

Notes

1. Followers of Keynes seldom anticipate recessions, never mind crises,

and so these things always surprise them. Followers of Ludwig von Mises,

Murray Rothbard and Hans-Hermann Hoppe, on the other hand, usually

anticipate downturns, crashes and crises―and are surprised when they (usually)

don't occur. To Keynesians, in other words, the glass isn't just full:

it's overflowing. Austrians, on the other hand, see a crack in a brittle

and mostly-empty vessel. As a result, Keynesians are normally complacent

and Austrians fretful.

2. See also “Austerity Europe: Who Faces the Cuts” (The Guardian, 12 June

2010); Brian Wesbury and Robert Stein (“Government Austerity: The Good,

Bad and Ugly,” Forbes, 27 July 2010); and Paul Krugman (“The Austerity

Agenda,” The New York Times, 31 May 2012).

----------------------------------------------------------------------------------------------------

*This is an adapted and shortened version of a paper presented to the

Mises Seminar Emporium Hotel, Brisbane, Queensland, on November 30,

2013.**Chris Leithner grew up in Canada. He is director of

Leithner & Co. Pty.

Ltd., a private investment company based in Brisbane, Australia. |