|

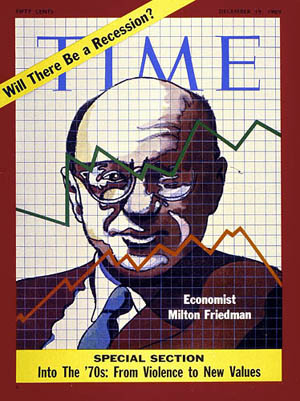

How Would Milton Friedman Have Reacted to

the Financial Crisis?* |

|

The repercussions of the financial crisis that began in 2007 are still

being felt. In the United States and in Europe, the crisis led to the

strong resurgence of a theory, Keynesianism, that seemed to have been

discredited since the 1970s. One of the main opponents of John Maynard

Keynes’s statist and interventionist conception of the economy, Milton

Friedman, who died in 2006, would have turned 100 this year. Friedman

was a fierce defender of the free market and is considered one of the

most influential economists of the last century.

What would Friedman think of the Keynesian stimulus policies adopted

practically everywhere in 2008, namely the spending programs of

governments and the money-creation programs of central banks? Would he

have systematically opposed them? The answer is not as obvious as one

might think.

The Logic of Stimulus Plans

For Keynesians, capitalism is a profoundly unstable economic system that

inevitably finds itself in crisis at regular intervals.

An unexpected shock is all that’s required to disrupt the behaviour of

market actors and derail economic growth. Investors, driven not by a

rational evaluation of risks and opportunities but by “animal spirits,”

shift suddenly from a blind optimism to an equally arbitrary pessimism. An unexpected shock is all that’s required to disrupt the behaviour of

market actors and derail economic growth. Investors, driven not by a

rational evaluation of risks and opportunities but by “animal spirits,”

shift suddenly from a blind optimism to an equally arbitrary pessimism.

This change of attitude leads to a slowing down of production, a rise in

unemployment and a decrease in household income. Consumers in turn lose

confidence, save more and buy less, which leads production to drop

further.

Since a capitalist economy, according to Keynes, possesses no automatic

stabilization mechanism, this spiral can go on indefinitely, until the

total collapse of the economy. Only the government, which has the means

to substitute its own actions for those of private actors in order to

sustain demand, can turn the situation around.

By spending on various programs and public works, the government puts

idle factors of production back to work. In addition, by lowering

interest rates and increasing the supply of money in circulation, the

central bank encourages consumers to spend and businesses to invest. For

Keynes, the debt and inflation that could result from these policies are

not serious threats.

With regard to the first aspect of stimulus plans, Friedman considered

the notion that public spending could raise overall demand and stimulate

the economy an unfounded presumption that focused solely on one part of

the equation.

It is easy to understand that if the government raises taxes in order to

spend more, then higher public spending will be offset by lower private

spending.

Even when government borrows funds, those who lend them will have to

reduce their own spending or lend less to other, private actors. “All

that happens is that government expenditures go up and private

expenditures down,” he wrote in Capitalism and Freedom, published

in 1962.

For Friedman, this propensity to increase spending and multiply programs

during a recession illustrates above all the dominance of intellectual

fashions and statist policies, and only served to feed the growth of the

state all through the 20th century. Indeed, most of the

programs supposedly created to stabilize the economy during the New Deal

and subsequent recessions were maintained afterward, and governments

continued to post deficits even in periods of economic growth.

Friedman would not have been at all surprised to see the mixed results

of the budgetary stimulus plans put in place since 2008, or the

government budgetary crises provoked by the taking on of massive debt

observed today in the United States and Europe.

Milton Friedman’s main contribution to the analysis of business cycles

is contained in his monumental A Monetary History of the United

States, 1867–1960, published in 1963 in collaboration with Anna

Schwartz.

It is in this work that he lays down the foundations of his monetarist

theory. This theory replaced Keynesianism as the monetary orthodoxy

starting in the late 1970s, when Paul Volker was named Chairman of the

Federal Reserve. Volker put the brakes on monetary creation and

implemented draconian interest rate hikes in order to rein in the

runaway inflation of the preceding years, at the cost of the recession

of 1980-1982.

|

|

“According to Milton Friedman

and Anna Schwartz, the reasons the crisis lasted so long is

not because of the inherent instability of a market economy,

but rather because of the ineptitude of the Fed.” |

|

The feature of Friedman’s monetary theories that is most often noted is

his opposition to a too-rapid increase in prices. Contrary to Keynesians

who had a very different explanation for such an increase, and in

accordance with classical economists, Friedman maintained that it was

inevitably provoked by a monetary policy that was too expansionist.

As he famously put it: “Inflation is always and everywhere a monetary

phenomenon in the sense that it is and can be produced only by a more

rapid increase in the quantity of money than in output.”

Monetarism also offers an explanation of the causes of the Great

Depression. According to Friedman and Schwartz, the reasons the crisis

lasted so long is not because of the inherent instability of a market

economy, but rather because of the ineptitude of the Fed.

According to them, during the 1930s, the Fed did nothing to prevent—and

it even at times deliberately provoked—a substantial reduction in the

money supply.

This policy led to the bankruptcy of thousands of banks and a drop in

national income, and it nipped any burgeoning economic recovery in the

bud.

At first glance, monetarism therefore appears to be a theory that

criticizes government action—central banks being monopolies established

by governments to create and manage the currency—and that defends the

free market.

Paradoxically, this explanation nonetheless makes Friedman an ally of

Keynes when it comes to monetary policy, the second aspect of stimulus

plans. Although their evaluations of the dangers of inflation diverge

considerably, Keynesians and monetarists actually agree on a crucial

point: that the central bank must, in the financial jargon, “inject

liquidity” into the economy in times of crisis. In other words, it must

artificially create currency in order to support economic activity,

protect banks from failure and prevent a temporary readjustment from

turning into a recession or an extended depression.

It is this policy that Volker’s successor, Alan Greenspan, put in place

for 19 years while he was Chairman of the Fed. Each time the American

economy showed signs of slowing down or experienced any crisis (the

stock market crash of 1987, the Savings and Loan Crisis, the Mexican

crisis, the Asian crisis, the Y2K bug, the September 11, 2001 attacks,

the bursting of the tech bubble, etc.), Greenspan stepped on the

monetary accelerator. An open supporter of the free market, he took

inspiration not from Keynes, but from Friedman.

During a conference on the occasion of Friedman’s 90th

birthday in 2002, the current Chairman of the Fed, Ben Bernanke, also

endorsed the analysis of Friedman and Schwartz: “I would like to say to

Milton and Anna: Regarding the Great Depression, you’re right, we did

it. We’re very sorry. But thanks to you, we won’t do it again.”

Since 2007, Bernanke has set up, not surprisingly, a series of

“quantitative easing” programs, another euphemism for the creation of

money from nothing. According to American journalist Penn Bullock, by

all accounts, Friedman would have approved of these measures. He writes

in Reason.com that while it is true that the Obama administration is

pursuing Keynesian fiscal stimulus, the Federal Reserve under Bernanke

has deliberately put in practice the lesson of Friedman and Schwartz on

the need to grow the money supply.

It is after all the same quantitative easing policy that Friedman had

suggested to the Japanese government, itself facing an economic crisis

following the bursting of a housing bubble starting in 1990: “The surest

road to a healthy economic recovery is to increase the rate of monetary

growth,” he wrote in 1997.

The Austrian Critique

More than three years after the start of the current crisis, there are

no signs that the stimulus plans, budgetary or monetary, have succeeded

in getting the economy back on a sustainable track.

For Keynesians like Paul Krugman, this is proof that they did not go far

enough. Monetarists inspired by Friedman are, for their part, on the

defensive. It is another theory, much more intransigently opposed to

government interventionism, that is gaining influence: that of the

Austrian School of economics, represented by economists Friedrich A.

Hayek and Ludwig von Mises, among others.

For adherents of the Austrian School (who, despite their name, are found

just about everywhere in the world today), supporters of a return to the

gold standard and a denationalisation of the currency, it is the very

existence of fiat money that is the source of the problem. Monetary

creation from nothing is a fraud perpetrated by the government upon

holders of currency, which moreover entails a misallocation of resources

and leads inevitably to recessions.

We cannot, as Friedman recommends, solve the problem by resorting to the

policies that caused it in the first place. By coming to the rescue of

the markets every time there was a slowdown, Greenspan only postponed

the crisis, and made it worse. From an Austrian point of view,

therefore, monetarists are in the end just as responsible for the

crisis, and for its continuation, as Keynesians are.

The most well-known proponent of Austrian economics is undoubtedly Ron

Paul, a Representative in Congress and a current Republican presidential

candidate. The author of a book entitled End the Fed, he warned

Americans about the danger of an overly expansionist monetary policy and

of a potential crash years before it happened, as did other commentators

inspired by the Austrian School.

According to Ron Paul, “Friedman’s very, very libertarian—except on

monetary issues.” Indeed, almost all of Friedman’s body of work was in

defence of individual liberty and the free market. He would no doubt

have denounced the Keynesian-inspired budgetary stimulus plans put in

place for the past three years.

However, if we take him at his word, he would have sided with the

Keynesians in favour of the monetary stimulus plans. Perhaps the current

crisis will bring about a paradigm change on this subject in favour of

another school of thought.

*This

article was originally published in French on January 21, 2012, in the

Montreal daily paper

Le Devoir.

Translation by

Bradley

Doucet.

|

|

|

From the same author |

|

▪

The fed's wireless hangup: Does Canada really need

more players in its telecom market?

(no

322 – May 15 2014)

▪

"L'Austerità" è Responsabile per la Crisi in Europa?

(no

313 – August 15 2013)

▪

Ist die "Austeritäts"- Politik schuld an der Krise in Europa?

(no

313 – August 15 2013)

▪

¿Es la "austeridad" responsable de la crisis en Europa?

(no

313 – August 15 2013)

▪

Sú ekonomické úsporné opatrenia zodpovedné za krízu v Európe?

(no

313 – August 15 2013)

▪

More...

|

|

|

First written appearance of the

word 'liberty,' circa 2300 B.C. |

|

Le Québécois Libre

Promoting individual liberty, free markets and voluntary

cooperation since 1998.

|

|