|

Long wars, it stands to reason, require deep pockets.

But more guns, “leaders” have assured their subjects, do not imply

less butter. Quite the contrary: spending of all kinds will rise

sharply. Not only are present “commitments” sacrosanct: other

bribes, particularly medical subsidies required to assuage aging

populations, will rise drastically. The anointed of America’s tax-consuming

caste state quite unapologetically, and its benighted tax-producers

accept credulously, how the state will finance these obligations:

the U.S. Government will graciously borrow and foreigners will

dutifully lend. The true “coalition of the willing” comprises the

savers and lenders of Asia and Europe. They underwrite America’s

welfare at home and its warfare around the world.

Today, surprisingly few people question whether this “long war” is

financially feasible; and virtually nobody is willing to canvass the

likelihood that it and the government’s other grandiose ambitions

will, in effect, push Uncle Sam into receivership (see, however,

"Avoid the Rush: Prepare Now for America’s Bankruptcy"). For better or

worse, perceptions about the U.S. Government’s creditworthiness

calibrate the world’s economic and financial thermostat. For decades

the conviction has been wide, deep and seemingly impregnable: U.S.

Treasury securities are the planet’s safest credit risk. The yield

of a Treasury bill has been the benchmark (or “risk-free”) rate of

return; and other assets (ranging from American corporate bonds to

European stocks to New Zealand real estate) are priced, if only

indirectly, relative to its yield. In recent years, the yields of

Treasury bills and bonds have stood at or near generational lows.

These ultra-low yields have helped to generate what by historical

standards are very high – and perhaps dangerously high – asset

prices.

But what if these yields are far lower than they ought to be? What

if, ironically, the “risk-free” rate is actually fraught with risk,

and Uncle Sam’s sovereign credit rating overstates his

creditworthiness? If so, then a disturbing possibility presents

itself: in the future this rating may be downgraded – conceivably to

“junk” levels. If that happens, then, to put it mildly, financial

and economic shocks will reverberate around the world.

Whether it occurs gradually or suddenly, any change to the overall

perception about America’s creditworthiness will, mostly through

upward pressure upon interest rates and downward pressure upon

securities’ prices, greatly influence financial markets and

standards of living. The stark reality is that if the financial

statements and debt securities of the U.S. Government were analysed

objectively – that is, by the same standards used to judge

developing countries like, say, Botswana – then its pristine credit

rating would fall. (Memo to Britons, Frenchmen, Germans and Japanese:

your governments are also paddling in leaky boats.) This conclusion

is not iconoclastic: one major ratings agency, Standard & Poor’s,

has taken it seriously enough to explore its implications (see in

particular

In The Long Run, We Are All Debt: Aging Societies and

Sovereign Ratings).

America’s national debt has increased from $77m in 1789 to $8.8

trillion (and rising rapidly) today. Its unfunded (“off-balance

sheet”) liabilities are at least $53 trillion, perhaps as high as

$70 trillion, and are climbing rapidly. But most people either

ignore or discount these developments. Yes, since the late 18th

century debt has risen to hitherto unimaginable heights – but so too

have standards of living. Observing this correlation, today’s

conventional wisdom infers that spending, particularly the debt-financed

variety, causes prosperity. More of the former, they believe,

necessarily produces more of the latter. This is America, its

residents and their rulers proudly assert; and they act as if the

laws of economics simply don’t apply to them. Debts and deficits, to

use the notorious phrase attributed to Dick Cheney,

simply don’t

matter. Major credit rating agencies apparently agree: despite the

mountains of debt and their brisk rate of expansion, all award the

U.S. the highest possible sovereign rating. The higher the rating,

the lower is the perception that a government will repudiate its

obligations, and the lower is the rate of interest creditors agree

to receive from the amounts they lend. On that basis, everybody

believes that Uncle Sam’s promises are as good as gold.

This perception raises the question: exactly how is a country’s

sovereign credit rating derived? Agencies do not reveal all of their

methods. But in "Determinants and Impact of Sovereign Credit Ratings"

(Federal Reserve Bank of New York, Economic Policy Review, October

1996), Richard Cantor and Frank Packer analysed handful of key

variables. They also remind us why a country’s rating is important:

among other things, it exerts a strong influence upon the ratings

assigned to corporate borrowers domiciled within that country.

Agencies seldom if ever assign a rating to a municipality,

provincial government or private company that is higher than that of

the issuer’s national government. This rule of thumb could one day

put agencies into an interesting bind. What, for example, would

happen to the spotless ratings of top-flight companies such as

Berkshire Hathaway if the U.S. Government’s rating were downgraded?

Sovereign ratings and changes thereto have vital implications for

investors, individual and corporate, around the world; and to

analyse and apply Cantor and Packer’s key rating variables

dispassionately is an eye-opening exercise (see also Eric Englund’s

"Should the US Government’s Sovereign Credit Rating be Downgraded to

Junk?").

The higher the average income within a country, note Cantor and

Packer, the bigger its government’s potential tax base. The bigger

the flock and the fatter its geese, the more the government can

steal. The more rapidly average income rises, in turn, the more

secure (from the state’s, as opposed to the income earner’s, point

of view!) the tax base; and the bigger and more secure a potential

tax-base relative to the state’s borrowings, the stronger is its

ability to repay debt.

Uncle Sam’s debts and liabilities, as well as American households’

debts and liabilities, are growing more rapidly than Americans’

“real” (i.e., net of CPI) incomes. The rate of growth of real

disposable personal income grew by 2.9% per year during the decade

to

2003. Since 2001 or so, this rate has been little related to the

growth of real GDP (see, for example,

these charts and comments). In

2005 it plunged to ca. 0%. It rebounded in 2006, to a rate of more

than 4% per year, but more recently has been decelerating. As a

result, since 1990 and net of CPI, Americans’ incomes have grown by

ca. 2-3% per year.

In 2005, the average household earned $45,000 of after-tax income

and owed approximately $8,000 of credit card debt, $12,000 of other

consumer debt and $65,000 of mortgage debt. It devoted approximately

13% of its after-tax income to the repayment of interest and

principal. This figure, known as the “debt-service ratio,” has in

recent years remained slightly above 13%, whereas the financial

obligations ratio (which incorporates other recurring expenses such

as rents, auto leases, homeowners’ insurance and property taxes that

decrease the uncommitted income otherwise available to households)

has hovered a bit above 18%. (For details, see

Credit Card Industry

Facts and Personal Debt Statistics and

American Housing Survey for

the United States: 2005.)

Since 1990, the average household’s total debt has increased at ca.

6.6% per year and roughly 40-50% of households, particularly lower-income

ones, presently spend more than they earn. Also since 1990, the sum

of Uncle Sam’s on- and off-balance sheet obligations has increased

at roughly 7.5% per year (see, for example,

U.S. National Debt Clock

FAQ). As the habit of saving has collapsed (the personal savings

rate as measured by the St Louis branch of the Federal Reserve has

fallen from 8.5% in the 1970s to 7.5% in the 1980s to 5.0% in the

1990s to less than 0.0% since 2002), the indulgence of borrowing has

exploded. During the past decade, consumers’ incomes have probably –

but not by a wide margin – outpaced their current expenditures. But

in two respects consumers have been fortunate. First, until recently

price rises in the supermarket, at the petrol bowser, etc. have been

restrained. Second, very low rates of interest have mitigated the

impact of the growing burden of debt. But what if the CPI and

interest rates revert towards longer term (multi-decade) averages?

If prices and rates rise at a quicker pace, then pressures upon

households will magnify. Under these conditions, households would

experience the “magic of compounding” in reverse.

“In evaluating household debt burdens,” said Alan Greenspan ("Understanding

Household Debt Obligations," 23 February 2004), “one must remember

that debt-to-income ratios have been rising for at least a half

century. With household assets rising as well, the ratio of net

worth to income is currently somewhat higher than its long-run

average. So long as financial intermediation continues to expand [that’s

bureaucratese for “as long as anybody who needs to borrow can do so

on easy terms”], both household debt and assets are likely to rise

faster than income.” In James Grant’s apt phrase, America’s

“leveraged condition” is proceeding apace. Alas, trees do not grow

to the heavens, actions have consequences and debt must be serviced

and ultimately repaid. Can households’ balance sheets forever expand

more quickly than their income statements?

But Dr Greenspan seemed to be relaxed. “Without an examination of

what is happening to both assets and liabilities, it is difficult to

ascertain the true burden of debt service. Overall, the household

sector seems to be in good shape, and much of the apparent increase

in the household sector’s debt ratios over the past decade reflects

factors that do not suggest increasing household financial stress.

And, in fact, during the past two years, debt service ratios have

been stable.” All true – at a time when mortgage rates were very low,

the prices of residential real estate buoyant and virtually anybody

who wanted a loan could get one. Do we still live in such times?

Will we do so during the next 5-10 years?

Hence another interpretation – one that might more accurately

describe a time when the market price of residential housing, which

comprises the bedrock of the typical household’s net worth, is (at

best) rising more slowly than hitherto, is stagnant in many areas

and is (at worst) falling. Modest rates of growth of personal income,

brisk rates of growth of personal and governmental debt and high

absolute levels of debt – in these respects, America’s tax base may

rest upon less-than-impregnably-solid foundations. If a country’s

sovereign credit rating depends upon its government’s ability to

confiscate, then the robber’s ability to plunder ultimately depends

upon its victims’ financial health. Just as many Americans (like

many Australians, Britons, Canadians, New Zealanders, etc.) who buy

petrol and shop in supermarkets suspect that the CPI is rising more

quickly than their rulers admit, they are also right to wonder

whether they are actually in less robust financial shape than their

overlords claim.

|

The External Balance of Trade and Finance

|

A deficit with the rest of the world indicates that a country’s

public and private sectors (considered as a whole) import some

combination of goods, services and capital from abroad. To consume

and invest more than one earns and saves is to borrow from the rest

of the world; and persistent and growing deficits increase

indebtedness to foreigners. The greater the debt and the quicker the

rate of growth of obligations, say Cantor and Packer, the less

creditworthy is the country.

Are Americans living beyond their means? No doubt some of them have

been, and the sub-prime mortgage imbroglio may well reveal that

their number is considerably greater than previously reckoned. But

even if the mortgage and residential real estate woes are deeper and

last longer than the optimists expect, it’s extremely unlikely that

Americans as a whole are candidates for bankruptcy. Is the U.S.

Government living way beyond its means? Almost certainly. A review

of American imports and exports of goods, services and capital that

distinguishes clearly between individuals/private businesses on the

one hand and governments on the other helps to corroborate these

points.

A first important point is that since the Second World War (and

probably since the early 19th century), individuals’ and businesses’ purchases of goods from abroad have tended to be producer goods (such

as machinery, semi-finished goods, etc.) rather than consumer goods

(such as plasma screen TVs, etc.). Further, during the past several

decades the composition of private sector imports has changed

notably. Consumption goods have comprised a steadily falling – and

production goods a steadily growing – percentage of all imports. The

classification of imports makes it difficult to distinguish producer

from consumer goods. Nonetheless, and according to Sudha Shenoy ("Is

America Living Beyond Its Means? Is That the Right Question?"),

consumer goods constituted a bit less than one-third of private

sector imports in the 1950s and 1960s, a quarter in the 1970s and

ca. 23% in

2004. Further, American business’ holdings of cash are presently

near an historical high and their borrowings relatively low. Hence

it does not appear that American individuals and businesses are

borrowing against (or selling) assets in order to finance the

purchase of foreign consumer goods.

A second point is that before ca. 1980 the U.S. was a net exporter

of goods and capital; since then, it has become a net importer of

all three. Since the early 19th century, America’s private sector

has imported capital from Europe. It still does, and Europe remains

the single biggest source of foreign capital. According to Shenoy,

Europe supplied 68% of total direct foreign investment in 1960 and

71% in 2004. Canada provided 28% of the total in 1960 but just 9% in

2004. Japan and all others provided 4% in 1960 and 20% in 2004.

Indirect (a.k.a. “portfolio”) investment – that is, buying shares

of companies rather than directly buying land and entire businesses

– has risen from a rather low base in the 1960s and now comprises a

majority of foreign investment in the U.S. According to some, this

reflects the attractions of American investments compared to

non-American ones. Perhaps.

Related to this second point is the rough correlation between the

U.S. household savings ratio and rising tide of capital imports.

Over the decades, American households have “outsourced” their

savings to foreigners. The savings which American households once

supplied to American banks (who then lent it to American businesses)

is now supplied mostly by foreigners. The gratification which

Americans once deferred – that is, the discipline to save and

consume less today in order to spend and consume more tomorrow – is

now held much less in check than it used to be. And although current

income continues to finance most of American households’ consumption,

a growing portion derives from borrowings (including borrowing

against “home equity”) and the sale of assets. Some Americans, then,

have been borrowing against (or selling) assets in order to finance

the purchase of (mostly domestically produced) consumer goods.

The bull in the China shop is clearly the U.S. Government. As the

supply of domestic savings has shrunk, Leviathan’s demands have

grown – and have thereby generated additional (i.e., in addition to private sector demand) and very large inflows of capital. These

borrowings began to rise in the 1980s (to ca. 17% of all capital

inflows), and since then have risen 2.5 times more quickly than

foreign inflows into the private sector. By 2004, 34% of capital

imported into the U.S. was earmarked for Uncle Sam’s domestic

welfare and international warfare. In Shenoy’s words, “beyond

argument, this is the exemplar of borrowing capital to finance

current spending.” Although he wasn’t so blunt, Fed Chairman

Benjamin Bernanke’s testimony to the Committee on the Budget of the

U.S. Senate ("Long-term Fiscal Challenges Facing the United States,"

18 January) did not disagree.

|

What the Mainstream Calls “Inflation” |

A high rate of “inflation” – that is, of growth of CPI – is,

according to Cantor and Packer, a sign that structural problems are

afflicting the government and its finances. The more marked the

tendency of consumer prices to rise, the less secure the

government’s tax base, the less creditworthy the government and

hence the riskier the debt it issues.

Like Alan Greenspan before him, Ben Bernanke never tires of

emphasising that the CPI – whose rise, he always omits to mention,

is an eventual consequence of inflation – is, compared to the 1970s

and 1980s, quiescent. To the extent that the Man in the Street

thinks about him, Dr Bernanke generates cognitive dissonance.

Americans know full well (because they buy groceries and petrol)

that some prices that are not supposed to rise are nevertheless

steadily rising; and because they read the real estate section of

the newspaper and look at estate agents’ displays, they see that

some prices that are supposed to rise are not (or aren’t rising

quickly enough). Yet they believe – and politicians fervently trust

– that The Chairman has everything under control.

According to John Williams ("Government Economic Reports: Things

You’ve Suspected But Were Afraid to Ask!" Part IV), however, the

hunches of the Man in the Street are correct:

|

Inflation, as reported by the Consumer Price Index (CPI), is

understated by roughly 7% per year. This is due to recent

redefinitions of the series as well as to flawed methodologies … In

particular, changes made in CPI methodology during the Clinton

Administration understated inflation significantly … In a like

manner, anyone involved in commerce, who relies on receiving

payments adjusted for the CPI, has been similarly damaged. On the

other side, if you are making payments based on the CPI (i.e., the federal government), you are making out like a bandit.

Williams concludes:

Traditional inflation rates can be estimated by adding 7.0% to the

CPI-U annual growth rate (3.8% +7.0% = 10.8% as of August 2006) or

by adding 7.4% to the C-CPI-U rate (3.4% + 7.4% = 10.8% as of August

2006) (see also "Haute Con Job" by Bill Gross).

|

Doug Noland of The Prudent Bear shares neither central bankers’

opinion about the CPI nor the general public’s (or financial

journalists’) opinion about central bankers. On 31 December 2004 he

wrote in his Credit Bubble Bulletin:

|

The U.S. economy is in the midst of a distorted boom, with an

increasingly ingrained inflationary bias. Asset bubbles are heavily

influencing spending and investing patterns, hence the underlying

structure of the economy. The nature of the U.S. bubble economy –

where gross financial excess is required to fuel minimally

acceptable employment gains – will be an issue for 2005. Current

market rates and liquidity conditions appear poised to initially

foster stronger-than-expected demand domestically and globally,

although the unstable and unbalanced nature of the current global

expansion will continue to provide fodder for those arguing for an

imminent slowdown. I expect the Chinese and Asian inflationary booms

to become increasingly problematic. Energy and commodities will

remain in tight supply, with prices extraordinarily volatile but

with a continued upward bias. The current minority Fed view that [a

rising CPI] and marketplace speculation pose increasing risks has

potential to become consensus. And I can certainly envisage a

scenario of increasingly anxious central bankers eyeing inflationary

pressures and unstable markets across the globe. |

| |

|

Growth of Gross Domestic Product (GDP) |

If a country enjoys a relatively high rate of economic growth,

Cantor and Packer reckon, then the burden of debt that exists at any

point in time will, if it remains stable or grows more slowly than

GDP, become easier to service over time. It is surely a coincidence!

Tell us it isn’t so! Not only does the CPI understate the extent to

which American prices are rising: GDP figures exaggerate the extent

to which the American economic pie is growing. Williams states in

Part V of his series

|

The Gross Domestic Product (GDP) is one of the broader measures of

economic activity and is the most widely followed business indicator

reported by the U.S. Government. Upward growth biases built into GDP

modelling since the early 1980s, however, have rendered this

important series nearly worthless as an indicator of economic

activity … The distortions from bad GDP reporting have major impacts

within the financial system … With reported growth moving up and

away from economic reality, the primary significance of GDP

reporting now is as a political propaganda tool and as a

cheerleading prop for Pollyannaish analysts on Wall Street. |

The problem is that the same entity – the U.S. Government – plays

the roles of economic advocate, judge and jury. The counterfeiter

who owns the printing press (and can thus depreciate the currency at

will) also arrogates to itself the measurement of economic growth.

The heart of the problem, of course, is that the state collects

economic statistics. Sir John Cowperthwaite(1): where is your

American opposite number? The official statistics that quantify the

welfare-warfare state’s untrammelled interventionism also provide

the basis for credit agencies’ assessments of that state’s

creditworthiness. Do Uncle Sam’s statistics depict the results of

his economic policies in the best possible light? Bill Gross, the

world’s biggest bond investor, expresses little doubt: “The rating

agencies must come to understand that the federal government is

putting out works of fiction with respect to the CPI and to GDP

growth.”

A solvent entity is one that is able to pay its debts and meet its

obligations when they become due. Individuals and private sector

organisations use voluntary means to remain solvent, and coercive

sector organisations use coercive and even violent means.

Governments service their debts and other liabilities with taxes or

proceeds from the sale of assets – both of which they have

confiscated from individuals and the private sector. So if you don’t

already know it, here’s something that you absolutely must keep in

mind whilst perusing a government’s financial statements: the assets

on its balance sheet have been stolen; the valuation of assets is

arbitrary but probably vastly overstated; and the extent of

liabilities is probably hugely understated (see in particular

Michael Rozeff’s excellent "Washington’s Assets Are Our Liabilities").

Also bear in mind that Uncle Sam’s financial condition is simply

unauditable. In his

comment on 2005’s

Financial Report of the United

States Government, his internal auditor (there is, of course, no

external auditor), the Comptroller General, found – yet again! –

that his financial statements are unreliable and that his financial

controls inadequate. In particular, “A significant number of

material weaknesses related to financial systems, fundamental

recordkeeping and financial reporting, and incomplete documentation

continued to

|

1. hamper the federal government’s ability to reliably report a

significant portion of its assets, liabilities, costs, and other

related information;

2. affect the federal government’s ability to reliably measure the

full cost as well as the financial and non-financial performance of

certain programs and activities;

3. impair the federal government’s ability to adequately safeguard

significant assets and properly record various transactions; and

4. hinder the federal government from having reliable financial

information to operate in an economical, efficient, and effective

manner.

Because of the federal government’s inability to demonstrate the

reliability of significant portions of the U.S. Government’s

accompanying consolidated financial statements for fiscal years 2006

and 2005, principally resulting from certain material weaknesses,

and other limitations on the scope of our work, described in this

report, we are unable to, and we do not, express an opinion on such

financial statements. As a result of these limitations, readers are

cautioned that amounts reported in the consolidated financial

statements and related notes may not be reliable … |

More generally, the financial management of the federal government’s

largest agencies fails to meet requirements enacted in 1996

(see "Accounting and Accountability in Government" by Karen de

Coster). The Department of Defence is the major offender. In 2001,

its Inspector General stated “we identified $1.1 trillion [yes,

that’s a “t” and not a “b”] in department-level accounting entries

to financial data used to prepare DoD component financial statements

that were not supported by adequate audit trails or by sufficient

evidence to determine their validity. In addition, we also

identified $107 billion in department-level accounting entries to

financial data used to prepare DoD component financial statements

that were improper because the entries were illogical or did not

follow accounting principles. . . . [In conclusion], DoD did not

fully comply with the laws and regulations that had a direct and

material effect on its ability to determine financial statement

amounts” (for details, see "The Government Needs to Get Its Own

Accounting House in Order" by Robert Higgs).

|

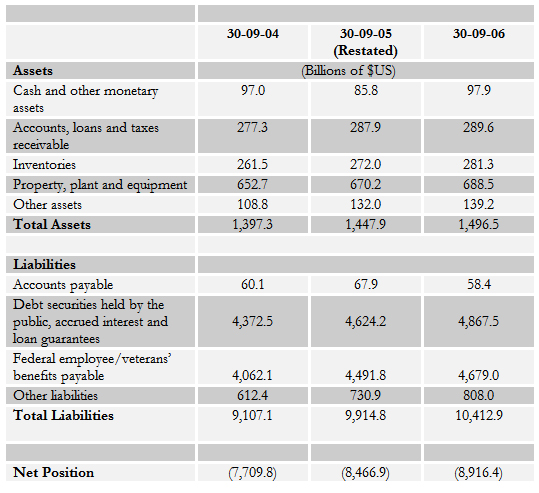

Table 1: There’s (Literally!) No Accounting for the U.S.

Government |

|

Uncle Sam resembles nothing so much as an inept, hopelessly

spendthrift and disorganised man who hurriedly stuffs a shoebox full

of whatever documents and receipts he can find – and then throws the

mess into a bewildered accountant’s lap. In the private sector,

people who generate massive waste and loss face the ire of

shareholders are usually denied access to capital, often receive

pink slips and running shoes and sometimes land in gaol. In the

coercive sector, however, mismanagement is virtually never punished.

Instead, it is typically lauded and rewarded. Given its shenanigans,

the U.S. Government’s balance sheet probably overstates its assets.

It is certain that it vastly understate its liabilities.

The notes to financial statements often use soporific words but

contain startling information, and the U.S. Government’s are no

exception. These notes blandly inform the reader that the

government’s balance sheet, or what passes for one, does not reflect

intra-governmental debt holdings. Nor does it include accrued

liabilities such as the net present value of Social Security,

Medicare and other obligations. Clearly, it grossly understates the

enormity of the U.S. Government’s deficit of net worth. The 2004

Financial Report, for example, contains a section entitled

“Liabilities and Additional Responsibilities.” It brings to the

surface the staggering scope of Uncle Sam’s liabilities:

|

The [30 September] 2004 balance sheet shows assets of $1,397 billion

and liabilities of $9,107 billion, for a negative net position of

$7,710 billion. In addition, the Government’s responsibilities to

make future payments for social insurance and certain other programs

are not shown as liabilities according to Federal accounting

standards; however, they are measured in other contexts. These

programmatic commitments remain Federal responsibilities and as

currently structured will have a significant claim on budgetary

resources in the future … The net present value for all of the

responsibilities (for current participants over a 75-year period) is

$45,892 billion, including Medicare and Social Security payments,

pensions and benefits for Federal employees and veterans, and other

financial responsibilities. The reader needs to understand these

responsibilities to get a more complete understanding of the

Government’s finances. |

| |

|