|

Will Interest Rates Remain Permanently Low? |

|

At extreme junctures the crowd is most prone to extrapolate the

unrepresentative present into the indefinite future. The result is that

the more intense is today’s craze, the more prominent are the intellects

that insist it’ll last. From this point of view, it’s hardly surprising

that the longer is the period of time during which rates of interest

fall and the lower the level to which they descend, the greater is the

number of people (particularly of influential and vocal people) who

believe – and the more fervent is their conviction – that rates will

certainly remain extremely low and probably fall even further.

I suspect that the conviction of today’s mainstream that “rates will

stay very low for very long” doesn’t just reflect their worship of

abstract models and fresh-and-blood central bankers, and their disregard

of the historical record: it belies their hubris that the future is

foreseeable and that our rulers, at least, can foresee it. I fear it’s

the old delusion (“it’s different this time”) in a new guise. When the

crowd celebrates the alleged exceptionalism of the times, it pays the

genuine investor to investigate contrary possibilities. Rather than

parrot the mantra that “rates will undoubtedly remain low,” it’s more

fruitful to consider the contrarian question: “what might happen when

they rise?”

Is it really different this time? The historical record demonstrates

convincingly that in one respect it undeniably is. Equally, there’s no

reason to think that it’ll remain so – and several to conclude that it

won’t. How to ascertain whether the present differs significantly from

the past? The most sensible way, it seems to me, is to analyse long

series of valid and reliable data. What’s the best way to consider

central banks’ discount rates and the yield of “risk-free” sovereign

debt? I believe it’s to put them into the longest possible context. What

institution provides this context? The Bank of England does.

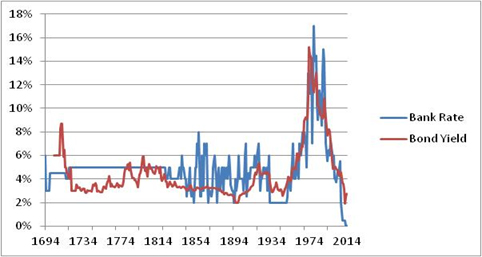

Using data from the BOE’s web site, Figure 1 plots the BOE’s base rate

since October 1694 and the yield of HMG’s long-term bonds since June

1703. It’s analogous to the Fed’s discount rate; as such, it strongly

influences longer-term rates including mortgages, corporate bond rates

etc.

Figure 1

Bank of England’s Base Rate and HMG’s Long-Term Bond

Yields, October 1694-December 2014

Two things in Figure 1 are clear: never has the Bank of England pushed

its base rate (1) remotely as low and (2) nearly as quickly as it began

to do late in 2008. In October of that year, the base rate was 5%; in

November, the Bank cut it to 3%; in December, to 2%; in February 2009,

to 1%; and in March 2009, to 0.5%. Within six months the Bank did

something that it had never done before: it slashed its base rate by 90%

(that is, (0.005 – 0.05) ÷ 0.05). Until February 2009, it had never set

it below 2%; since March 2009, it’s pinned it at a mere one-quarter of

that level. The period since early 2009 has no historical precedent; in

that sense, it is indeed fundamentally different this time.

Although the present is unprecedented, I suspect that the future (which,

alas, I can’t foresee) won’t be: that is, since June 1822 the base rate

has fluctuated erratically around its long-term mean – which from 1694

to October 2008 was 4.82%, and for the entire series (1694-2014) is

4.77%. What’s a “normal” base rate? Figure 2 provides a range of means

from which to choose. Whichever you prefer, the “normal” rate greatly

exceeds the average since 2009.

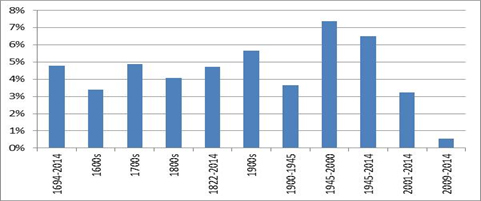

Figure 2

Bank of England, Average Base Rate during Various

Intervals, 1694-2014

Sometimes the base rate soared far above its overall mean: in

particular, during most of the 1970s and 1980s it exceeded 12%. At other

times it sagged well below its mean: during the 75 years after 1835 it

averaged 3.7%, and during the 1930s and 1940s it averaged 2.3%. Notice,

however, that during these below-average periods both base rate and bond

yield frequently spiked well above their overall averages.

Slightly above-average and slightly below-average base rates have

prevailed for great lengths of time. Most notably, the rate remained

constant at 4.5% for 17 years (i.e., from June 1699 to June 1716) and at

5.0% for an astounding 103 years (i.e., from April 1719 to May 1822).

The bulls can indeed point to extremely long periods during which the

Bank of England never changed its bank rate. They can also cite extended

intervals of below-average rates.

Two inconvenient (for the bulls) facts remain. The first is important

enough to repeat: at no time has the base rate ever fallen as far and as

fast as it did in October 2008-March 2009. Second, at no time has it

remained as low as it has since March 2009. A slightly below-average

rate existed – albeit hardly continuously – for ca. three-quarters of a

century after 1835; but the record low which has prevailed since March

2009, or indeed anything like it, has never done so.

Hence our impudent question to today’s bulls: if since 1694 it’s never

been different (in the sense that you intend), then why – apart from the

lame reason that central banks must suppress their base rate in order to

support the bacchanalia – should anybody expect that the next 70 (or

even 20 or 10) years will be different from any other corresponding

period between 1694 and 2008?

Eschewing the bulls’ exuberance and bearing in mind that since 1822 the

Bank of England’s base rate hasn’t over time conformed to a rigid,

replicable and hence reliably and profitably predictable pattern, we can

express our scepticism more specifically. Figure 1 shows that the base

rate has tended, erratically but eventually, to regress from extremes

towards its overall mean. So too the long-term bond’s yield: lower

yields eventually follow above-average ones, and higher yields follow

below-average ones. If things aren’t, after all, different this time,

then it’s reasonable to expect that at some point – alas, neither I nor

you or anybody else knows when, but it’ll likely take us all by surprise

– not only will rates rise: they’ll also revisit their super long-term

average. When they do, I suspect that there will be hell to pay.

The Decrease of Rates Since the Late-1970s/Early-1980s

Why, generally speaking in most Western countries, have rates of

interest fallen almost continuously – and cumulatively massively – since

the 1980s?

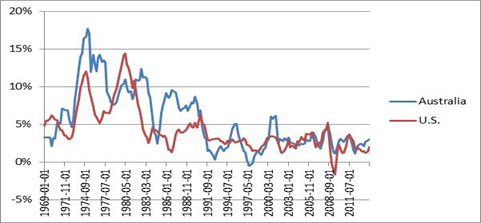

Figure 3 plots the yield of 10-year U.S. Government and Australian

Government bonds since July 1969 (when directly-comparable data became

available). Why 10-year securities? They’re a mid-point between the

longest-dated “risk-free” debt (the 30-year U.S. Treasury bond) and its

shortest-term counterpart (Treasury bills whose duration is one year or

less). And as we’ll shortly see, the 10-year has become the primary

means whereby the Treasury finances the U.S. Government’s deficit.

Figure 3

The Yield of Ten-Year Government Securities,

Australia and U.S., 1969-2014

Both series in Figure 3 tell much the same story: yields rose in the

1970s, peaked in the early 1980s and thereafter have fallen almost

continuously. In the U.S. since 1969, the ten-year yield has averaged

6.8% and in Australia it’s averaged 8.5%. Treasuries’ average yield

since 1969 has differed little from British gilts’ (which isn’t shown);

the average rate of ten-year Commonwealths, on the other hand, exceeds

the gilts’ and Treasury 10-years’ average.

The most significant (statistically, it explains more than one-third of

the total variation since 1969) proximate cause of changes of rates of

interest is the deceleration of the Consumer Price Index (CPI). Figure 4

plots the annualised increase of CPI in Australia and the U.S. since

1969. Like the 10-year yield, so too the CPI: it rose rapidly in the

1970s, peaked in the mid-1970s (Australia) and early-1980s (U.S.) and

thereafter has decelerated almost continuously. In the 1970s, CPI

averaged 6.9% in the U.S. and 9.2% in Australia; in the 1980s, it

averaged 5.6% in the U.S. and 8.4% in Australia; in the 1990s, it

averaged 3.0% in the U.S. and 2.5% in Australia; and since 2000 it has

averaged 2.4% in the U.S. and 3.0% in Australia.

Figure 4

CPI (Quarterly Observations), Australia and the

U.S., 1969-2014

Other things equal, an acceleration of CPI causes yields to rise and a

deceleration causes them to fall. Bonds’ yields rise in response to an

increase of CPI (more precisely, yields rise when lenders expect that

the cumulative CPI during the duration of their loan will accelerate)

because the increase of CPI erodes the future purchasing power of bonds’

principal and payments of interest. In the 1970s, as CPI accelerated,

long-term investors’ “real” (net of CPI) returns from 10-year Treasuries

fell. These and other investors began to expect that CPI would remain

high and rise higher. In order to protect themselves against this

erosion and to generate a positive rate of return, lenders demanded much

higher rates of interest; accordingly, Treasuries’ yields steadily rose.

In the early 1980s, investors feared that the rise of CPI might return

to the levels (above 10% per annum) it had scaled just a few years

before; accordingly, and in order to protect themselves against this

possible severe erosion of their purchasing power and to generate a

positive rate of return, they demanded compensating very high rates of

interest. Conversely, once CPI’s rise decelerated towards 3% per annum

and investors became convinced that it’d stay there, they became willing

to lend at far lower rates.

With that thought in mind, let’s consider matters as they stand today.

In the year to 30 September 2014, the yield of the 10-year U.S. Treasury

has averaged 2.53% and CPI has averaged 1.75%. Do you see the risk that

its purchasers face? Let’s assume (to the crowd it’s an article of

faith) that CPI accurately measures prices and their changes over time.

Also assume (I doubt it, but who knows?) that this rate of change of CPI

will remain constant during the next decade.

Given these assumptions, consider as an example the investor who

purchased a 10-year Treasury (again, for simplicity assume a purchase

price of $100) yielding 2.53% in 2014. After 10 years, if CPI increases

at a constant rate of 1.75%, in nominal terms the investor will receive

total payments of interest of $25.30; net of the effect of the very low

CPI, he’ll receive $22.97; and when Treasury redeems the bond in 2024,

he’ll receive principal whose nominal value will be $100 but whose

purchasing power is $83.80. After ten years under these circumstances,

the investment’s purchasing power increases from $100 in 2014 to $106.77

(i.e., $83.80 + $22.97) in 2024. That’s a “real” compound rate of return

of 0.66% per year.

Even given rosy (I’d call them “aggressively optimistic”) assumptions,

the real rate of return the investor can realistically expect is less

than 1% per year. Is that sufficient compensation for the risks he

takes? What if even slightly less optimistic conditions prevail? If, for

example, during the next decade CPI averages 2.4% (its average since

2000) the “real” rate of return decreases to -0.1% per year. Any average

rate of CPI greater than 2.4% per year generates increasingly bigger

losses. Under current circumstances, Treasuries don’t seem to offer

“risk-free” return; if anything (the phrase is James Grant’s), they

promise return-free risk! Who’d buy these securities under today’s

unappealing circumstances? In order to protect against the risk that an

unexpectedly high rate of increase of CPI erodes the purchasing power of

their capital, and to generate an acceptable “real” rate of return, I

suspect that at some point sooner than 10, 20 or 70 years lenders will

demand more adequate compensation. What if, for example, they demand a

rate of return (net of CPI) of 2% per year? Assuming that during the

next decade CPI rises 2.5% per year, purchasers of 10-year Treasuries

must demand a yield of 4.6% – which is much closer to its long-term

historical average, and almost double its average during 2014.

Why Has CPI Decelerated and Remained Stable?

Since the early 1980s, rates of interest have fallen primarily because

the CPI’s rate of increase has decelerated. Why has its rate of increase

slowed? Two sets of reasons: the first is largely market-based and

therefore beneficial, legitimate and maintainable; the second is wholly

non-market and hence harmful, illegitimate – and, I suspect, untenable.

-Three Largely Market-Based Reasons

Deng Xiaoping – China’s leader from 1978 until his retirement in 1992 –

symbolises the first reason. Of course, he didn’t single-handedly cause

the CPI’s rate of increase in Australia, the U.S. and elsewhere to slow.

Beginning in 1979, however, he commenced a series of economic reforms

which have expanded and accelerated over the years and whose cumulative

scope and consequences have no precedent. Hundreds of millions of

Chinese peasants began to manage and own the land they cultivated and to

sell their output on domestic markets. At the same time, China’s economy

quickly opened to foreign trade and investment. As a result, since the

late-1970s its imports of food have plummeted and its exports of ever

more advanced goods (produced by scores of millions of people who’ve

migrated from the countryside to rapidly-growing cities) have exploded.

Never before, surely, have so many risen so quickly from such abject

poverty.

China and other “emerging economies” have become the world’s biggest

producers and primary suppliers to Western nations of a vast number of

ever more advanced goods which Westerners were once the leading

producers. Not just because their labour has been quite inexpensive (but

progressively less cheap over time) by Western standards, but also

because their technology has usually approached and sometimes exceeded

Western standards, the emergence of China and other developing countries

as major forces in the international economy has increased the supply of

goods and services relative to the supply of money. Developing nations’

rise to prominence in a more integrated (“globalised”) world economy has

(and other things equal) caused CPI in Western countries to increase

less rapidly than it otherwise would.

|

|

“I suspect that the conviction of today’s mainstream that

‘rates will

stay very low for very long’ doesn’t just reflect their worship of

abstract models and fresh-and-blood central bankers, and their disregard

of the historical record: it belies their hubris that the future is

foreseeable and that our rulers, at least, can foresee it.” |

|

Bill Gates symbolises a second reason. Neither he nor Steve Jobs or any

other CEO single-handedly caused its rate of increase to slow. They do,

however, epitomise the IT revolution, dating roughly from the late

1970s, which has enhanced the productivity of production, transport,

marketing and distribution. Better IT enables a given amount of output

to occur at lower cost (or more output at the same cost). Other things

equal, these advances of productivity increase the supply of goods and

services relative to the supply of money, and thereby place downward

pressure upon the prices of goods and services. Nowhere has this

phenomenon been more apparent than in the computing and IT industries.

Sir Roger Douglas and Paul Keating (the Treasurer, not the PM) provide a

third reason. As much as anybody, and more than most, each promoted

reforms that commenced in all Anglo-American countries (but later and

much less thoroughly in Western Europe) in the late 1970s. These

reforms, which by the late 1980s had become near-orthodoxy, have

enhanced domestic competition for goods, services and labour. More

vigorous competition, in turn, has (again, other things equal) tended to

place downward pressure upon prices.

-Two Non-Market Reasons: Heavy Purchases by Foreigners and the Fed

How does the government affect rates of interest? Specifically, how does

its fiscal policy (namely the size of its budget’s deficit or surplus)

affect rates? “The conventional view,” say Douglas Elmendorf and Gregory

Mankiw (Government

Debt,

Federal Reserve Board, Finance and Economics Discussion Series,

1998-1999), “is held by most economists and almost all policymakers.

According to this view, the issuance of government debt … ‘crowds out’

capital and reduces national income in the long run.” Fifteen years

later, that remains the mainstream’s assessment. It’s not wrong: in

plain English, and assuming that the deficit is financed solely from

domestic savings and holding constant the policy of central banks (which

are vital caveats which we’ll revisit), the government finances a

deficit of (say) $1m by borrowing $1m – that is, by issuing to the

general public securities of whose total face value is $1m.

Private investors exchange this amount of cash, which the government

then spends, for the government’s newly-issued bills, bonds and notes.

The cash which private investors use to buy these debt securities

cannot, of course, simultaneously be put to other uses – such as the

purchase of private sector bonds, shares and other securities. The

government’s deficit thus reduces the total quantity of investable funds

but leaves unaffected private entities’ demand for these funds. The

greater is the size of the government’s deficit relative to the private

sector borrower’s demand for funds, the more the government’s demand for

finance “crowds out” the private sector’s.

Like a game of musical chairs in which the number of contestants exceeds

the number of chairs, the unchanged private demand for a diminished

(after the government’s issue of securities) supply of funds increases

competition for these funds. How do private borrowers ensure that

they’ll win a seat (i.e., obtain funds) before the music stops? They

offer more attractive terms and conditions – namely higher rates of

interest – to lenders. Unless domestic savers suddenly increase their

propensity to save, or the private sector’s demand for investable funds

subsequently decreases, or the government finds some alternate source of

finance, given the aforementioned assumptions a government which

consistently runs deficits will place upward pressure upon rates.

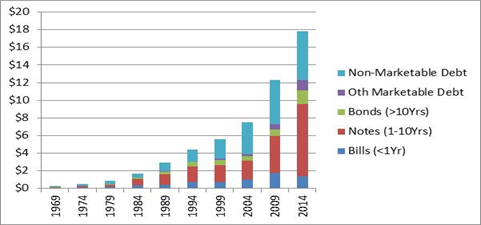

The phrases “America’s national debt” and “total face value of the U.S.

Treasury’s outstanding securities” are synonyms. Figure 5 stratifies the

U.S. Government’s debt obligations according to their duration: the

Treasury’s bills are short-term debt (repayable less than one year); its

notes are medium-term (repayable in 1-10 years); and its bonds are

long-term (payable in 11-30 years).

Figure 5

The U.S. Government’s Debt Obligations, Total and

Major Components ($US Trillion), 1969-2014

Debt has grown from $259 billion in 1969 to $17.829 trillion in

mid-2014. That’s a compound rate of growth of 9.9% per year. The size of

America’s economy, measured by Gross Domestic Product (GDP) in nominal

dollars, has increased from $1.02 trillion in 1969 to $16.77 trillion in

mid-2014. That’s a compound rate of growth of 6.7% per year. If only

parenthetically and rhetorically, it’s nevertheless worth asking:

whether for an individual, household, corporation or government, can

debt indefinitely grow more quickly than gross income (revenue)?

At first glance, the analysis to this point disconfirms the contention

that large and rising deficits place upward pressure upon interest

rates. Not only has the U.S. Government generated deficits virtually

without exception since 1969: its cumulative deficit – that is, the

national debt – has grown exponentially. Yet these large and rising

deficits clearly haven’t impeded the almost continuous decrease of rates

of interest since the early 1980s. Much lower rates have accompanied

far bigger deficits. How can this be? Recall the two assumptions: first,

domestic savings provide the sole source of deficit finance; and second,

central banks’ policies remain constant. In 1969, these assumptions

corresponded roughly to reality; by 2014, however, both had long ceased

to do so.

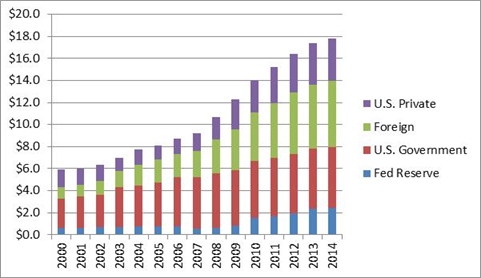

Figure 6 disaggregates America’s national debt into four categories of

ownership (directly-comparable data are available only for the years

since 2000). In 2000, private American entities (such as insurance

companies, investment funds, etc.) owned ca. one-quarter of all Treasury

securities. This percentage had fallen from more than one-half in 1969.

By 2014, this percentage fell further, to ca. one-fifth. Private

American investors, in other words, were once the U.S. Government’s

primary source of finance; but since at least 2000, they no longer do

so. The government’s deficits no longer “crowd out” private investors

because it now has other – and more significant – sources of finance.

Who are they? Foreigners – specifically, foreign central banks.

Figure 6

Who Owns the U.S. Government’s National Debt?

Major Components ($US Trillion), 2000-2014

In 1969, foreigners owned a negligible percentage (less than 5%) and

amount ($6 billion) of Treasuries; of these, private (including

corporate) investors in Britain, Canada, France and Germany comprised

most of this amount. By 2000, foreign holdings had skyrocketed to ca. $1

trillion (15% of the total) and in 2014 to $6 trillion (33%).

Particularly noteworthy are China and Japan: in each country in

mid-2014, central banks owned ca. $1.4 trillion of Treasuries (relative

to their populations, South Korea and Taiwan are also big holders).

Why have foreigners, particularly the People’s Bank of China and the

Bank of Japan, become (apart from the Fed and U.S. Government) the

biggest holders of Treasuries? Asian central banks, using domestic

currency they’ve conjured out of thin air, have long purchased huge

amounts of $US. These transactions have decreased the demand for their

currencies relative to supply; they’ve also boosted demand for $US. As a

result, central banks have depressed these currencies’ rates of exchange

vis-à-vis the $US – and cheapened the price in $US of their exports to

the U.S. These central banks have then used significant quantities of

their vast $US reserves to buy Treasuries. These purchases, in turn,

have accommodated America’s skyrocketing budget deficits. Because

they’ve become the biggest buyers of Treasuries, Asian countries’ strong

demand has boosted Treasuries’ prices and thereby suppressed their

yields. Asian central banks have become and remain such eager purchasers

of Treasuries that the U.S. Treasury has been able to sell them under

increasingly advantageous (to the Treasury) terms and conditions. Yet

these terms and conditions also suit Asian central banks: since

Treasuries’ yields provide the benchmark for other rates, Asian central

banks’ voracious appetite for Treasuries has also suppressed the yields

of sovereign and corporate debt in China, Japan, Korea, Taiwan and

elsewhere.

Since 2007, foreigners and the Fed have comprised a strong majority –

ca. 70% – of the total; and of this total, moreover, foreigners have

demanded the lion’s share. Since 2007, in other words, the U.S.

Government has depended primarily upon the Fed and major foreign central

banks to finance its growing deficits. These central banks’ strong

demand for Treasuries has increased their prices and thereby suppressed

their yields.

What Have the Fed and Other Central Banks Wrought?

What happens if and when these central banks decide to decelerate

the rate at which they accumulate Treasuries – or even decrease their

holdings? Assuming that it continues to run big deficits, either the Fed

must buy (monetise) more debt or the U.S. Government must offer

significantly better terms and conditions – that is, materially higher

rates of interest – in order to entice other borrowers. What’s the

likelihood that China’s demand for U.S. Treasuries will abate? For a

decade, studies have found “evidence that some types of investment are

becoming excessive in China, particularly in inland provinces.” In these

regions, economic activity has become more dependent upon superabundant

and hence wasteful capital investment, whose object is the export of

consumer goods and whose impact is short-lived,

necessitating ever

higher levels of [wasteful] investment to maintain economic activity. By

contrast, private consumption has become more self-sustaining in coastal

provinces, in large part because investment here tends to benefit

household incomes more than corporates. … Thus, investment should not be

indiscriminately directed toward urbanization or industrialization of

Western regions but shifted toward sectors with greater and more lasting

spill-overs to household income and consumption. (Il

Houng Lee, Murtaza Syed and Liu Xueyan,

China’s Path to Consumer-Based Growth: Reorienting Investment and

Enhancing Efficiency, IMF Working Paper WP/13/83, March 2013.)

In short, if China’s economy successfully evolves from heavy

concentration upon capital investment and the export of goods towards

greater focus upon domestic consumption of goods and services, then its

dependence upon exports, the People’s Bank of China’s need to suppress

the currency’s rate of exchange – and thus the Bank’s need to buy U.S.

Treasuries – will all lessen. Perhaps something along these lines has

begun to occur: in November 2013, the PBC announced that it intends to

decelerate its accumulation of foreign currencies (including $US).

According to Seeking Alpha (People’s

Bank of China Announces End of U.S. Treasury Buying,

22 November 2013), its purchases of Treasuries will therefore slow.

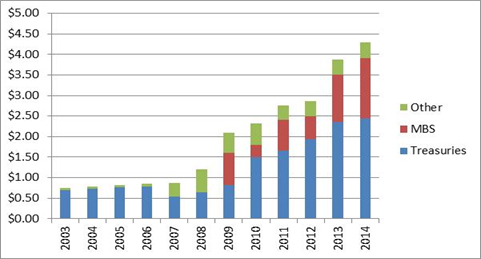

Figure 7, which quantifies the rapid growth of the size as well as the

change of composition of the Fed’s balance sheet, summarises another

potential source of trouble. In particular, it shows the effects of

Quantitative Easing (QE) upon its balance sheet.

Figure 7

U.S. Federal Reserve’s Assets, Total and Composition

($US Trillion), 2003-2014

The Fed’s assets have grown from $870 billion in 2007 to $4.29 trillion

in mid-2014. That’s a compound rate of growth of 22% per year – much

faster than the national debt’s rate of growth, and even more rapid than

GDP’s. Before 2007, other assets (mostly foreign currencies the Fed buys

and sells in order to manipulate the price of the $US) comprised 10% or

less of total assets, and do so today. In 2007-2008, however, other

assets (purchased as part of the bailout of the mega-insurer AIG, etc.)

exploded to ca. $1 trillion and 40% of the balance sheet. Since then, as

these assets have been sold and unwound, the “other assets” category has

returned to ca. 10% of the total. Traditionally, and as late as 2006,

Treasuries comprised virtually all (90%) of the Fed’s assets. Since

2007, these assets zoomed five-fold (from $0.5 trillion in 2007 to $2.5

trillion in 2014). Yet their relative importance has diminished to ca.

60% of total assets in 2014. Why is this? It’s a result of the sudden

purchase of trillions of dollars of Mortgage Backed Securities (MBSs),

which in turn stems from the Fed’s policy of Quantitative Easing (QE).

To the extent that the central bank purchases securities that are

riskier than the government’s bonds, it also lowers those assets’

yields. If, for example, it purchases MBSs aggressively then it will

suppress their yields – and perhaps keep afloat mortgagees, or at least

the owners of the mortgages, who borrowed too much (and the banks that

lent too much). QE thus tends to boost the prices of certain financial

assets and to lower their yields, while simultaneously increasing the

monetary base in an attempt to spur much greater borrowing and lending.

What has QE wrought? The Fed now owns many of the “toxic assets” that

bankers created in 2003-2007. These assets’ losses (ca. $360 billion in

mid-2014) could conceivably reduce the value of the Fed’s assets below

the value of its liabilities, i.e., bankrupt the Fed. Under these

circumstances it “would need an injection of capital from the Treasury”

– that is, a bailout (see in particular Norbert Michel and Stephen

Moore,

Quantitative Easing, the Fed’s Balance Sheet and Central Bank Insolvency,

Heritage Foundation Backgrounder No. 2938, 14 August 2014). If

the Fed is potentially bankrupt and might require a bailout from the

Treasury (which is bankrupt in the sense that it cannot meet ca. $200

trillion of liabilities at 100 cents in the dollar as and when they fall

due), then, in effect, two bankrupts are underpinning the solvency of

the economy and financial markets. How “sustainable” is that?

Yet Janet Yellen, Ben Bernanke’s successor as the head of the FOMC,

isn’t merely unfazed: she’s upbeat. She “doesn’t see … the risk that the

extremely low rates [of recent years] could destabilise the financial

system” (Yellen

Sees Little Threat to Stability,

The Australian, 3 July 2014).

… Ms Yellen spoke one day after the Dow Jones industrial average set a

record for the stock market. Some critics of Fed policies have warned

that the central bank could be setting the stage for another dangerous

bubble by keeping rates so low for so long. But in her speech, Ms Yellen

said she didn’t see dangerous excesses in the financial system. She said

that there were “isolated areas of increased risk taking” but that those

could be dealt with through regulatory changes rather than by raising

rates.

Janet Yellen points to today’s tiny rates of interest as evidence that

the Fed’s “stimulus” since 2008 has succeeded. So does Ben Bernanke (Bernanke

Tells U.K.’s King: “We Saved Our Economies”,

MarketWatch, 29 December 2014). In sharp contrast, I regard them

as dangerous experiments whose consequences (namely reckless lending,

borrowing, investment and consumption) will cause havoc when rates

revert towards their long-term means. Easy money today merely defers

harder decisions to tomorrow. Am I crazy or is Janet? Am I too cautious

or is the mainstream too confident? Are the bulls right to boast that

rates won’t rise? Or, deep down, do they really fear that they

mustn’t rise because the consequences will be so dire?

An explosion of debt

Since the late 1970s in most Western countries, indebtedness (whether

corporate, household or government) has exploded. Yet because rates of

interest have cumulatively plunged, the burden of debt has eased. We can

summarise the era’s conventional wisdom: “Long-term saving and

entrepreneurship is for chumps; borrowing, speculation and get-rich

quick is for champs.” Events in 2007-2009 dented this alleged wisdom but

haven’t overturned it. The updated (post-2009) version might read: “In a

bull market, the way to wealth is debt. In a bear market, debt is the

way to oblivion; alas, the bear can arrive suddenly and seemingly (to

the crowd) without warning. Nobody can reliably ring a bell which

announces the end of the bull and the start of the bear.”

Debt is often called “leverage” because it magnifies financial results.

It facilitates the sale of businesses, cars, houses, etc., to buyers who

otherwise couldn’t afford them; it thereby makes the boom broader and

longer than it otherwise might be. But when the cycle turns the process

reverses. Marginal transactions, which debt financed, must be unwound

through foreclosure or bankruptcy; the prices of assets, which debt

boosted to unrealistic heights, must fall – and a chain reaction crimps

the prices of other assets. When over-extended borrowers reap the

whirlwind of what they’ve sown, debt proves to them, conclusively, that

they couldn’t afford these things after all.

Debt is thus the fair-weather friend par excellence. It’s your

best mate on the upside and your worst enemy on the way down. Ever more

experts and market participants are regarding the events of 2008-2009 as

an inexplicable aberration rather than the consequence of profligate

causes; hence they’re striking it from their memories. As they see it,

so long has the financial sun been shining that the skies will never

darken. But if you’re prepared to stand apart from the crowd and can

acknowledge at least the possibility of an extended spell of inclement

financial weather, it’ll behove you to reflect upon the indebted

American (and Australian, British, Canadian, Chinese, European,

Japanese, etc.) condition, and to consider the likelihood that one day

debt – and the central banks that have spawned it – may become just as

reviled as it’s now revered.

I’ve long pondered how investors might avoid – and even profit from –

this course of events. Not only does the severe recession, vicious bear

market and precipitous increase of rates that occurred during the 1970s

figure heavily in my thoughts: so too does a specific event that

occurred in Stockholm little more than 40 years ago. On 9 October of

1974, the Bank of Sweden Prize in Economic Science in Memory of Alfred

Nobel (commonly and falsely known as “the Nobel Prize in Economics”) was

co-awarded to a scholar who believed that the prize shouldn’t exist.

In his acceptance speech on 11 December, the Austrian-born and Austrian

School economist, Friedrich Hayek (1899-1992), noted that regarding

economics as a science fuels “the pretence of knowledge” – that is,

élites’ dangerous conceit that society is putty that they can mould into

a shape that conforms to their desires (and their models’ parameters).

Hayek, in contrast, contended that society is far more complex than we

realise, and certainly far more than a team of Ph.D.s with arcane

models, huge amounts of data and powerful computers can possibly manage.

Government interventions of recent years – ZIRP and QE are merely the

tip of a vast iceberg – indicate that our rulers really do believe,

despite common sense and recent experience, that they can plan and

manage the economy. Alternatively, perhaps they’ve become desperate

because they simply don’t know what else to do.

The elite’s ignorance-garbed-as-hubris backfires, always and usually

spectacularly, bringing in its wake what Hayek dubbed “unintended

consequences.” The unprecedentedly extreme policies hastily enacted to

extend the boom of 2003-2007 and to quell the crisis of 2007-2009 have,

I suspect, merely set the stage for and lit the fuse of yet another

crisis. When will it erupt? Alas, if only I could see the “foreseeable”

future! Were he here today, it’s unlikely that central bankers’

recklessness would either surprise or impress Hayek. “Instead of

furthering the inevitable liquidation of the maladjustments brought

about by the boom during the last three years,” he wrote in 1932,

all conceivable means have been used to prevent [the] readjustment from

taking place; and one of these means, which has been repeatedly tried

though without success, from the earliest to the most recent stages of

depression, has been this deliberate policy of credit expansion [and

suppression of interest rates]. … To combat the depression by a forced

credit expansion is to attempt to cure the evil by the very means which

brought it about; because we are suffering from a misdirection of

production, we want to create further misdirection – a procedure that

can only lead to a much more severe crisis as soon as the credit

expansion comes to an end (see the Preface to Hayek’s Triangles: Two

Essays on the Business Cycle, Laissez-Faire Books, 2013).

Little – least of all our rulers’ hubris – surprises Bill Bonner,

president of Agora Publishing and co-author of Empire of Debt: The

Rise of an Epic Financial Crisis (John Wiley & Sons, 2006). “The

Fed’s EZ money policies,” he says,

will either succeed or fail. Either

way, it will be a disaster. If they succeed, interest rates will rise …

and America’s debt-addicted economy will get the shakes. If they fail,

the Fed will double down with further acts of reckless improvisation –

including bigger doses of credit – until the whole thing blows up (Interest

Rates: Something Wicked This Way Comes,

The Daily

Reckoning,

9 July 2013).

Interventionists’ attempts to plan the economy centrally have repeatedly

failed dismally. Have we any reason to expect that “it’s different this

time” – that is, that ZIRP, QE and all the rest won’t, like all other

interventions, trigger unintended negative consequences (first economic

stagnation, finally financial crisis)? |

|

|

From the same author |

|

▪

Frank Knight's Economic and Social Theology

(no

326 – November 15, 2014)

▪

Austerity, What Austerity? Europe Desperately Needs

"Genuine Austerity"

(no

317 – December 15, 2013)

▪

The shameful treatment of Ron Paul by the mainstream

media

(no

300 – May 15, 2012)

▪

The Evil Princes of Martin

Place – Introduction

(no

286 – February 15, 2011)

▪

The return of Keynesianism

(no

278 – May 15, 2010)

▪

More...

|

|

|

First written appearance of the

word 'liberty,' circa 2300 B.C. |

|

Le Québécois Libre

Promoting individual liberty, free markets and voluntary

cooperation since 1998.

|

|